Global coordination: critical mineral projects

And it’s not just the US with it’s wide-spread intervention to bridge the scale and cost challenges in taking on China rare minerals dominance.

A G7 meeting of energy and environment ministers in Canada, is to focus on financing tools, offtake contracts with floor pricing, and stockpiling to underwrite non-Chinese supply;

- Canada has pledged US$4.6 billion to accelerate critical mineral projects, including rare earths;

- Australia is considering price floors and offering financial lifelines to processing companies; in Brazil,

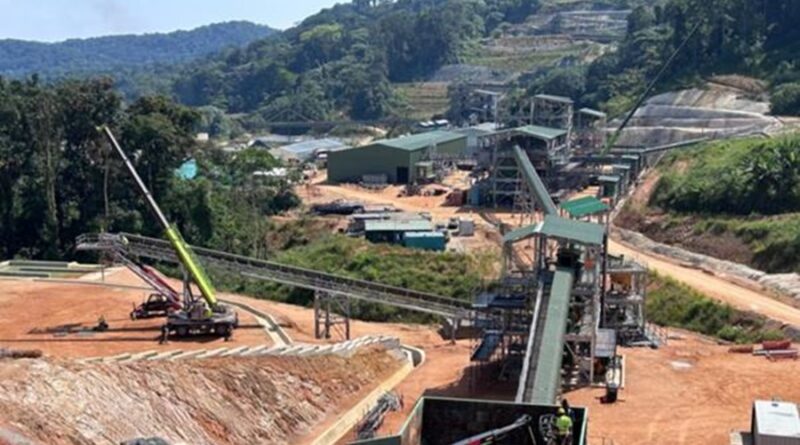

- the US-led Minerals Security Partnership backed Brazil’s Serra Verde rare earths project as the only mine outside Asia currently producing both light and heavy rare earths;

- the EU Critical Raw Materials Act set 2030 benchmarks to extract 10%, process 40%, and recycle 25% of EU needs.

- Africa, in particular Namibia, is also emerging as one of the most strategically important regions for new supply. Namibia hosts high-grade monazite-type rare earth deposits, including the key magnet elements NdPr, and offers a stable democracy, mining-friendly policies, and growing Western investment interest.

Several rare earth assets are already moving through development with an eye on supplying US, EU and Japan processing hubs.