Northam Platinum produces 10.6% increase of PGM from own operations

Northam Platinum’s equivalent refined metal from own operations increased by 10.6% to 434 977 oz 4E (H1 F2023: 393 309 oz 4E). Zondereinde’s metal production was flat, as expected ahead of the commissioning of 3 shaft, whilst growth from the Booysendal South mine and Eland was in line with our forecast.

Group production of chrome concentrate increased by 31.8% to 666 692 tonnes (H1 F2023: 505 841 tonnes), on the back of increased UG2 tonnages and recovery improvements at all operations. This was particularly pleasing, given the recent strengthening of the chrome price.

The group continued to progress its strategic goals of sustainably growing safe production down the sector cost curve. Challenges remain, particularly in respect of metal prices, mining inflation and the potential for higher frequency and longer duration Eskom load curtailment events. Our capital growth programme remains on-track and is improving our operational resilience during the current weak market conditions.

A key feature has been the solid production performance achieved by all operations. Zondereinde has benefitted from focussed Merensky stoping in the Western extension, together with logistics decongestion resulting from the ongoing shift in UG2 stoping from the western to the eastern portions of the mine.

Booysendal delivered growth on the back of strong production from North mine, as well as the ongoing ramp-up of South mine. Eland production is ramping up on schedule with stoping production up by 170%, while mineable reserves have almost doubled.

This has yielded a 51.8% increase in 4E metal production from own operations and surface sources and a 100.0% increase in chrome concentrate.

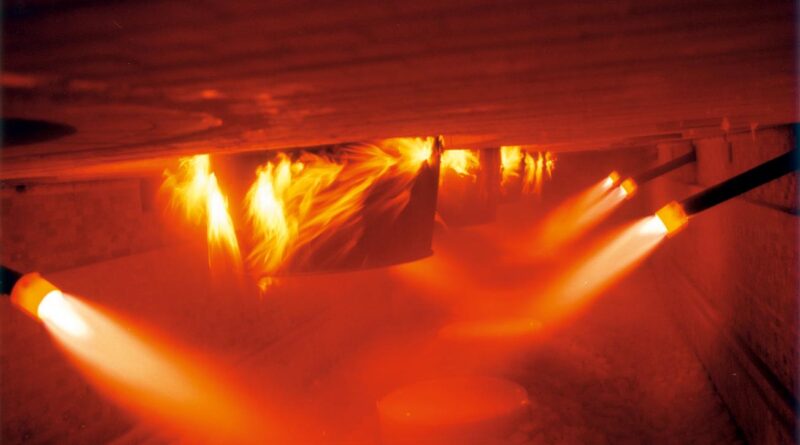

The successful, on-schedule completion of a new 4.5 metre diameter raise-bored ventilation shaft during December 2023 has created environmental conditions in the deeper sections of the mine which are critical to the medium-term schedule.

All operations have been subject to numerous Eskom load curtailment events, however, the combination of our comprehensive load management protocols, as well as increased on-demand self-generation capacity, is limiting consequential production losses. The group’s programme to further increase self-generation capacity is well advanced and will assist in mitigating potential losses resulting from Eskom load curtailment events. Furthermore, all safety metrics show improvement from the previous financial year, with both Booysendal and Eland remaining fatality free since inception.

The increase in group unit cash costs has been limited to 6.7%, despite the ongoing trend of generally higher mining inflation. Northam Platinum’s have benefitted from growing mining production, improved concentrator feed grades and disciplined, focussed cost control.

The total cost of purchased concentrates and recycling material increased by 32.0% to R2.1 billion (H1 F2023: R1.6 billion), with 4E ounce volumes purchased increasing by 114.5%. The cost of purchased material is based on ruling commodity prices as well as the relevant prill split of the purchased material.