Largest gold miner reports significant Q4 earnings

The world’s largest gold miner reported strong earnings and reaffirmed its commitment to reward shareholders as it improves its balance sheet.

On Thursday after the North American equity market close, Newmont (NYSE: NEM, TSX: NGT) reported solid earnings growth with adjusted net income of $1.6 billion or $1.40 per diluted share, up from $0.50 per share reported in the fourth quarter of 2023. The company’s earnings significantly beat expectations as analysts were forecasting growth of $0.92 per share.

For the year, the company reported an adjusted net income of $3.48 per diluted share and adjusted EBITDA of $8.7 billion.

Looking at its balance sheet, Newmont generated $6.3 billion of cash from operating activities, net of working capital changes of $1 billion. Because of increased production and higher gold prices, the senior producer said it saw record free cash flow of $1.6 billion in the fourth quarter. The company’s free cash flow increased by 115% from the third quarter.

“2024 was a transformational year for Newmont, as we focused on the integration of the Newcrest portfolio, divestment of our non-core assets, and transitioning the business onto a stable operating and investment platform. We have deliberately streamlined Newmont into the world’s best collection of Tier 1 gold assets, with a strong foundation of operational and financial performance. Our record fourth quarter gave a glimpse into the promising potential of the business and allowed Newmont to deliver record operating cash flows,” said Tom Palmer, Newmont’s President and Chief Executive Officer. “With the gold price predicted to remain strong and the proceeds from our divestiture program expected to materialize during the first half of 2025, we expect our balance sheet and liquidity to remain robust.”

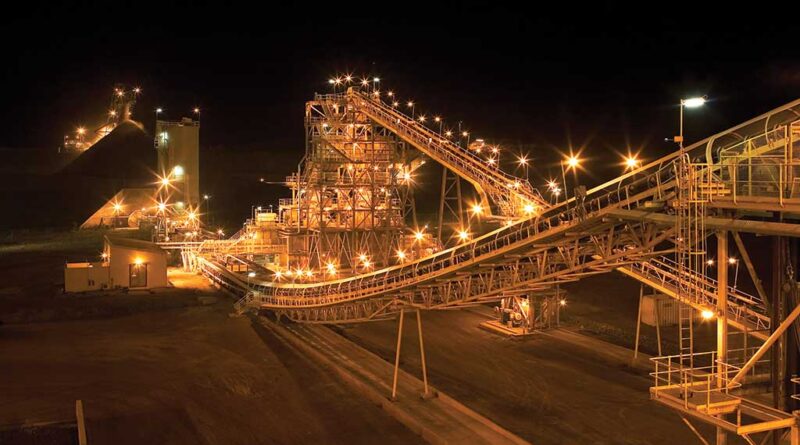

2024 was a busy year for Newmont as it continued to develop its portfolio of Tier 1 assets, divesting itself of non-core assets. The company said it could potentially generate up to $4.3 billion in total proceeds from non-core assets and other investment sales, including up to $2.5 billion in cash within the first half of this year.

While production increased, the company said it managed to keep costs in line. Newmont said its All-in-Sustaining Costs fell 9% in the fourth quarter to $1,463 an ounce. Meanwhile, its average realized gold price was $2,643 per ounce.

Looking ahead, Newmont said it expects to produce 5.9 million gold ounces this year with costs rising slightly to $1,630 an ounce.