Sibanye-Stillwater: Lithium refinery to be completed in Q3 2025

The SA PGM operations delivered another consistent operational performance with PGM production of 1,835,410 4Eoz (including attributable production from Mimosa and third-party purchase of concentrate (PoC)) 4% higher than for 2023 and within annual guidance of 1.8 to 1.9 million 4Eoz for 2024. PGM production excluding third party PoC for 2024 of 1,738,946 4Eoz was 4% higher than for 2023. Third party PoC of 96,464 4Eoz for 2024 was in line with 2023, but 20% higher than guided for 2024 (80,000 4Eoz).

The strategic importance of the Group’s diversified portfolio of metals, is again evidenced by the significant increase in the financial contribution of the SA gold operations to the Group. Despite significant restructuring, these mature mines buoyed by the tailwind of a strong gold price in a challenging period for most other metals, which are more aligned with industrial economic cycles, delivered materially better financial results for 2024. Adjusted EBITDA from the SA gold operations increased by 66% year-on-year, from R3.5 billion (US$193 million) for 2023 to R5.8 billion (US$323 million) for 2024 (R3 billion loss in 2021). The 66% increase in adjusted EBITDA from our SA gold operations has provided a critical underpin for the Group, comprising 45% of Group adjusted EBITDA for 2024, from 17% the year before.

The Sandouville nickel refinery financial and operational performance improved in 2024 compared to the previous year as a result of reduced costs and better plant stability and reliability.

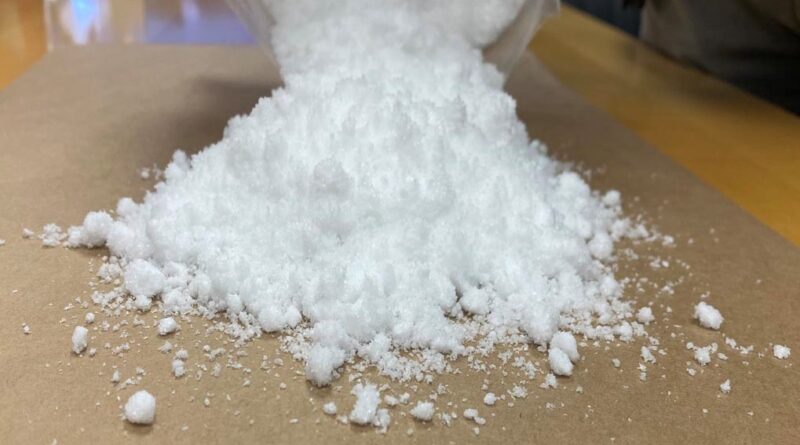

Construction activities at the Keliber lithium refinery in Kokkola, Finland have continued with good progress. The main equipment installations are being finalised and pre-commissioning activities will start in Q1 2025. The lithium refinery is expected to be completed in Q3 2025, with cold commissioning commencing thereafter.

The Century zinc tailings retreatment operation (Century operation) produced 82 kilotonnes (kt) of payable zinc metal for 2024 (76kt for the 10 months in 2023) at AISC of US$2,317/tZn (R42,446/tZn) below guidance of 87kt to 100kt at the beginning of 2024, due to severe disruptions caused by external factors. As stated, production for Q1 2024 was impacted by heavy wet season conditions which caused numerous interruptions to production. After a strong production recovery during Q2 and Q3 2024 with good operational consistency, production was again heavily impacted in Q4 2024 by a regional bushfire which engulfed the mine on the 9 October 2024, damaging 23km of poly piping, vital for operating activities. After replacing all the damaged infrastructure, normalised levels of production were only achieved in early December 2024.

The Mt Lyell feasibility study (AACE Class 3 Estimate) was completed in H1 2024. Positive project economics indicated an immediate transition to the next stage of required study (AACE Class 2 Estimate), scheduled for completion in H2 2025.