Green Metals play crucial role in clean energy technologies

Green metals play a crucial role in the development of clean energy technologies, including solar panels, electric vehicles and electricity networks. The World Bank estimates that the production of green metals could increase by about

500% by 2050 to meet the growing demand for clean energy technologies.

Africa’s abundance of green metal reserves presents large opportunities for investors and exporters and positions the continent to play a key role in the global green economy. However, persistent challenges, including extreme climatic conditions, skills shortages and concentration of minerals in particular countries, could hinder Africa’s ability to harness these opportunities.

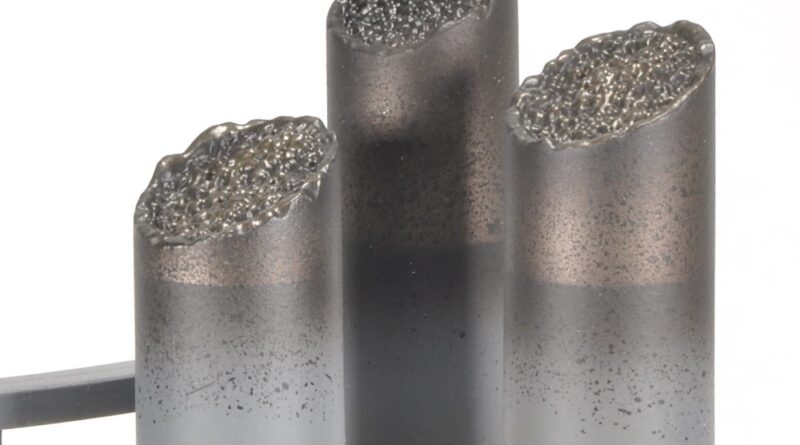

The green metals critical to the clean energy transition include copper, lithium, nickel, manganese, cobalt, graphite, chromium, molybdenum, zinc, silicon and rare earth elements.

In the green metals sector, copper is mainly used in technology used to generate wind and solar energy, while lithium and cobalt are primarily used as key components of electric vehicle batteries. Thus, clean energy technologies and new energy vehicles are the major drivers of demand for green metals.

The total production of green metals amounted to about 44.2 million metric tonnes, representing a 5.8% increase from 2020. Copper and manganese accounted for 48.5% and 48% of total green metals production respectively, mainly because they are traditional metals that are also used outside the green space. Lithium and manganese recorded particularly strong growth of 10.1% and 7.8% respectively.

The production of green metals is highly concentrated in certain countries, which means supply is affected by market developments in those countries. Five countries currently dominate the production of green metals: the Democratic Republic of Congo (DRC) (cobalt, 69.2%), Chile (copper, 26.3%), Australia (lithium, 48.9%), China (graphite, 63%) and South Africa (manganese, 33.5%). In the case of four green metals, China is one of the top-five producers globally, elevating the risk of geographic concentration.