Mining and overall real GDP growth start 2025 on the back foot

As expected, real GDP growth momentum weakened in the first quarter (Q1) of 2025 as the economy expanded by only 0.1% quarter-on-quarter (q-o-q). This was weaker than the downwardly revised 0.4%1 GDP increase recorded in the fourth quarter of 2024. Despite the notable easing in growth momentum, the actual outcome was somewhat above the Bloomberg market consensus that real GDP growth stalled (no growth) in Q1. Like in Q4 2024, and also for calendar year 2024, the annual (y-o-y) rate of real GDP growth was only 0.5% in Q1 2025.

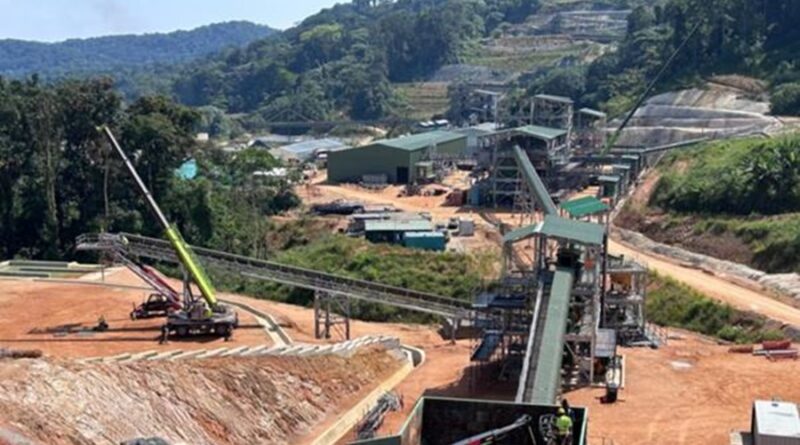

There was broad based sluggishness amongst the major economic sectors, with six of the ten major sectors contracting in Q1, while four posted increased activity. Amongst the sectors that contracted, mining performed the worst in the first quarter. In real terms, mining GDP declined by a notable

4.1% q-o-q. This decline subtracted 0.2 percentage points from overall real GDP. The manufacturing sector also shaved 0.2 percentage points from quarterly GDP, courtesy of a 2% q-o-q decline. On the upside, the agricultural sector continued to recover from weakness in the first half of 2024.

The sector expanded by a significant 15.8% q-o-q, adding 0.4 percentage points to overall real GDP in Q1 and making the biggest positive contribution.

Coming back to mining, the strain experienced in the industry is emphasised by the following:

- The sector is in a technical recession. After also recording a (small) quarterly contraction of 0.1% in Q4 2024, the mining sector now meets the recession definition. This is characterised by two consecutive quarters of declining mining GDP.

- Mining GDP has experienced a quarterly decline in four of the last five quarters. As an aside, the demand-side GDP data indicates that real private sector investment has also declined in four of the last five quarters. This speaks to low business morale and is an important factor that explains the sluggish GDP growth in recent quarters.

- Compared to Q1 2024, real mining GDP declined by 4.2% y-o-y.

- Poor mining sector profitability in the first quarter. This is reflected in Stats SA’s gross operating surplus numbers, a broad measure of profitability. The poor profitability was despite a 1.3% q-o-q increase in the SA Reserve Bank’s export commodity price index in Q1. This was driven by the sustained rise in the gold price. At least in part, the weak profitability can be explained by the poor production figures at the start of the year.

- The compensation of mining sector employees increased by 2.6% y-o-y in the first quarter, below an increase of 3.9% in the non-mining sectors of the economy

Regarding the weak mining production in Q1, Stats SA mentioned that the production of platinum group metals (PGM) performed the worst. Disruptions to PGM mining activity due to heavy rain in the northern provinces in January and February largely accounts for the underperformance. The weather-related disruptions were not limited to the PGM sector, with production also curtailed in the chrome, gold and building materials industries. Because weather was the major driver of the poor mining sector performance in Q1, we should see some recovery in the second quarter.

Outlook

For a durable recovery, mining requires an improved regulatory environment

In the near term (next several months), mining production should recover from the Q1 weather-induced weakness. However, uncompetitive electricity pricing, ongoing constraints in rail and port logistics, as well as global trade tensions are likely to cap the pace of the recovery in mining output and profitability. Therefore, it remains essential that the domestic mining policy environment is supportive of a growing mining sector.