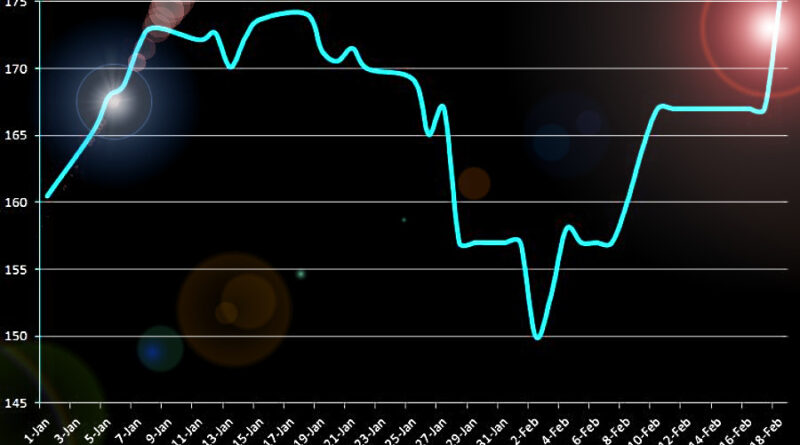

Surge in iron ore price as markets reopen in China

After its New Year Holidays, China’s market reopened on 18 February 2021 with benchmark 62% Australian iron ore fines surging by USD 8.17 per tonne or 5% to climb to USD 175 per tonne CFR Qingdao, hitting their highest level since September 2011.

Iron ore 58% fines closed at USD 160.22 per tonne CFR Qingdao, up USD 7.56 per tonne & 65% Brazilian iron ore fines climbed to USD 198 per tonne CFR Qingdao, up USD 7.80 per tonne.

Analysts from Citi alleged “We would not be surprised if iron ore briefly trades above its historic high of USD 190 achieved in February 2011, but we do not see it as likely that prices would stay there for a sustained period of time.”

Group Chief Executive Ms Elizabeth Gaines of Fortescue Metals commented “Not only in China, but the ex-China activity is also picking up to pre-covid levels. Our view is that the market will remain robust for some time.”

Conversely, Fitch said “The surge in iron ore price between the second and fourth quarter of 2020 has run its course. Prices should grind lower during the first half of this year as supply improves and demand growth slows. On the supply side, improving production growth from Brazil will help to loosen tight supply in the seaborne market. In terms of demand, the strong rebound in China’s demand for iron ore that began in the second quarter of last year is likely to slow during the first quarter of this year as winter steel production cuts take effect and well worked inventories encourage buyers to pause purchases at currently high prices.”