AFRIMAT: Iron ore mines recorded an overall increase of 29,7%

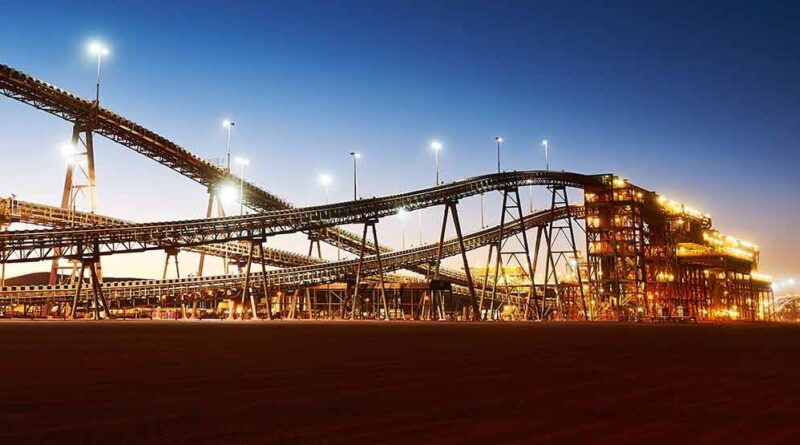

The Bulk Commodities segment, consisting of the iron ore mines and an anthracite mine, contributed 72,3% to the Group’s operating profit.

The sustained strong performance was largely due to the advantages of diversification across the iron ore business. International iron ore sales volumes reduced by 10%, due to rail limitations. This decrease was offset by a favourable Rand/US$ exchange rate and an increase in local iron ore sales volumes.

The iron ore mines recorded an overall increase of 29,7% in iron ore sales volumes compared to the same period in the previous year, with local sales tonnes increasing from 247 748 to 493 184 and international sales tonnes decreasing from 428 504 to 383 924. The segment has managed to generate a steady operating profit margin of 36,4% when compared to the prior period of 37,0%, despite the volatility of the iron ore price. Iron ore exports have continued to generate strong cash flow for the Group in line with the export allocation on the Saldanha rail line.

Driehoekspan which formed part of the Coza acquisition is being brought into production to maintain export volumes and add small volumes of manganese sales. The combined iron ore mines have a life of mine in excess of 15 years.

Optimised efficiencies continue to result in cost savings and in turn have countered the rise in input costs and fluctuations of the international iron ore price.

The Nkomati anthracite mine has contributed 18,1% to the segment’s revenue for the period. It produces

a high-quality product sold into the local market, as a replacement for imported anthracite, and is recognised as a consistent, reliable supplier of anthracite.

Extraction of the first anthracite from the underground mine and the establishment of two additional opencast pits will ensure a consistent feed to the plant. Although the ramp-up to steady state was slightly delayed, post the period end, processing volumes and logistics show steady improvement.

Industrial Minerals businesses across all regions delivered satisfactory results, however the impact of loadshedding was felt directly and also indirectly by certain customers which cut back on volumes and this resulted in a decrease in operating profit of 13,1% from R36,8 million to R32,0 million.