BHP raises iron ore production by 2% in the 2021 financial year

Total iron ore production increased by two per cent to 254 million tonne. Production of between 249 million tonne and 259 million tonne is expected in the 2022 financial year.

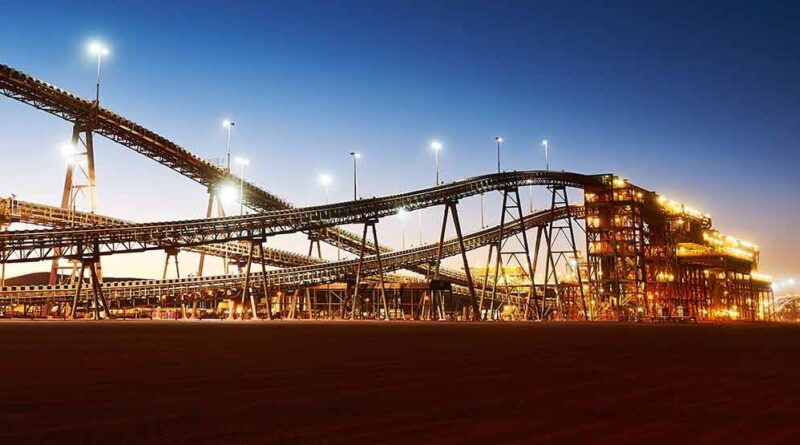

WAIO production increased by one per cent to a record 252 million tonne (284 million tonne on a 100 per cent basis), reflecting record production at Jimblebar and Mining Area C, which included first ore from South Flank in May 2021.

This was achieved despite significant weather impacts, temporary rail labour shortages due to COVID-19 related border restrictions and the planned Mining Area C and South Flank major tie-in activity. Strong operational performance across the supply chain reflected continued improvements in car dumper performance and reliability, and train cycle times.

Vandi resource has commenced its end-of-life ramp-down as South Flank ramps up and is expected to continue to provide supply chain flexibility with a lower level of production to continue for a few years.

Production of between 246 million tonne and 255 million tonne (278 million tonne and 288 million tonne on a 100 per cent basis) is expected for the 2022 financial year as WAIO continues to focus on incremental volume growth through productivity improvements. We continue with our program to further improve port reliability and this includes a major maintenance campaign on car dumper one planned for the September 2021 quarter.

Samarco production was 1.9 million tonne following the recommencement of iron ore pellet production at one concentrator in December 2020. Production of between 3 and 4 Mt (BHP share) is expected for the 2022 financial year. Production capacity of approximately 8 Mtpa (100 per cent basis) is expected to be reached in the second half of the 2022 financial year.

Metallurgical coal production decreased by one per cent to 41 million tonne (73 million tonne on a 100 per cent basis), in line with original guidance. Production is expected to be between 39 million tonne and 44 million tonne t (70 million tonne and 78 million tonne t on a 100 per cent basis) in the 2022 financial year as we expect restrictions on coal imports into China to remain for a number of years.

Production is expected to be weighted to the second half of the year due to planned wash plant maintenance in the first half of the year.

At Queensland Coal, strong underlying operational performance, including record production at Goonyella facilitated by record tonnes from Broadmeadow mine, was offset by significant wet weather impacts across most operations earlier in the year, as well as planned wash plant maintenance at Saraji and Caval Ridge in the first half of the year. At South Walker Creek, despite record stripping, production decreased as a result of higher strip ratios due to ongoing impacts from geotechnical constraints and lower yields.

Energy coal production decreased by 17 per cent to 19 million tonne. Production is expected to decrease to between 13 million tonne and 15 million tonne in the 2022 financial year, reflecting the announced divestment of our interest in Cerrejon in June 2021 and those Cerrejon volumes will now be separately reported from 1 July 2021 until transaction completion.

NSWEC production decreased by 11 per cent to 14 million tonne t despite increased stripping. This decrease reflects significant weather impacts and higher strip ratios, as well as lower volumes due to an increased proportion of washed coal in response to widening price quality differentials, consistent with our strategy to focus on higher quality products, and reduced port capacity following damage to a shiploader at the Newcastle port in November 2020.

The shiploader is expected to be back in operation during the September 2021 quarter. Production is expected to be between 13 million tonne and 15 million tonne in the 2022 financial year reflecting a continued focus on higher quality products.

Cerrejon production decreased by 30 per cent to 5 million tonne mainly as a result of a 91-day strike in the first half of the year and subsequent delays to the restart of production, as well as the impact of a reduced operational workforce due to COVID-19 restrictions.

On 28 June 2021, BHP announced it had signed a Sale and Purchase Agreement with Glencore to divest its 33.3 per cent interest in Cerrejon. The transaction has an effective economic date of 31 December 2020. Subject to the satisfaction of customary competition and regulatory requirements, we expect completion to occur in the second half of the 2022 financial year.

BHP Chief Executive Officer Mike Henry said “BHP safely delivered another year of excellent operational performance and its second consecutive financial year with zero fatalities at our operated assets. We set several production records and brought on four major projects safely, on schedule and on budget. We achieved production records at our Western Australia Iron Ore operations and the Goonyella Riverside metallurgical coal mine in Queensland. We maintained all-time high concentrator throughput at our Escondida copper mine in Chile. Olympic Dam in South Australia had its highest annual copper production since BHP acquired the asset in 2005, and its best-ever gold production. South Flank, the largest and one of the most technically-advanced iron ore mines in Australia, began production in May and will boost the overall quality of BHP’s iron ore product suite. In the same month, the Ruby project in Trinidad and Tobago started production. Atlantis Phase 3 in the Gulf of Mexico and the Spence expansion in Chile began production in the first half of the year.”