Boston Metal to start high value ferroalloy production

Boston Metal, the company delivering a future where steel production is emissions-free, announced that Vale and Energy Impact Partners have joined its Series B fundraising, closely following a USD 50 million close announced in January.

The company’s Series B also includes new investors BHP Ventures, Piva Capital, and Devonshire Investors, the private investment firm affiliated with FMR LLC, the parent company of Fidelity Investments, alongside existing investors Breakthrough Energy Ventures, Prelude Ventures, OGCI Climate Investments, and The Engine.

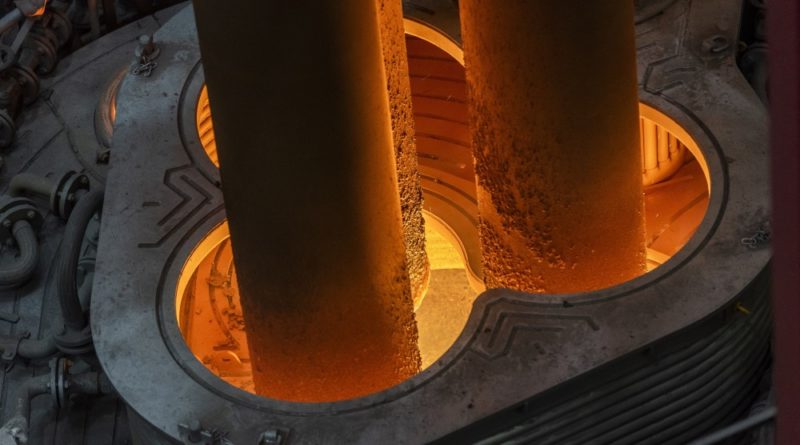

The Series B will allow Boston Metal to validate its patented inert anode technology at industrial-scale, further expand its team, and deploy its molten oxide electrolysis process with customers, starting with high value ferroalloy production as it advances toward steel applications.

Boston Metal has a diverse shareholder base which includes venture capital funds, mining companies and private investors.

Boston Metal is a pre-operating company, founded in 2012 by professors from the Massachusetts Institute of Technology (MIT), whose objective is the development of an innovative technology called Molten Oxide Electrolysis (MOE), which reduces metal oxides such as iron ore with the use of electricity.

This MOE process will enable the reduction of iron ore for the production of steel with zero CO2emissions. The amounts raised by Boston Metal will be used to finance the development of the technology.