Eastern Platinum reports results for the second quarter of 2024

Vancouver, British Columbia, August 13, 2024 – Eastern Platinum has reported that it has filed its condensed interim consolidated financial statements for the three and six months ended June 30, 2024:

- Revenue for Q2 2024 decreased to $18.8 million (Q2 2023 – $36.6 million), representing a $17.8 million or 48.6% decrease. Revenue for YTD 2024 decreased to $34.5 million (YTD 2023 – $54.7 million), representing a $20.2 million or 36.9% decrease.

- Mine operating income decreased by $8.9 million (or -66.9%) to $4.4 million in Q2 2024 (Q2 2023 – $13.3 million) as gross margin declined to 23.6% in Q2 2024 from 36.2% in Q2 2023. Mine operating income in YTD 2024 decreased by $7.1 million (or -42.3%) to $9.7 million (YTD 2023 – $16.8 million), resulting from a reduced gross margin of 28.2% in YTD 2024 from 30.7% in YTD 2023.

- Operating income was $1.6 million in Q2 2024 compared to $10.4 million in Q2 2023. Operating income was $1.6 million in YTD 2024 compared to $12.2 million in YTD 2023.

- Net income attributable to equity shareholders was $3.5 million in Q2 2024 versus net income attributable to equity shareholders of $7.7 million in Q2 2023. The decrease in Q2 2024 net income was largely attributable to lower chrome sales in the quarter offset by a decrease in finance costs and a foreign exchange gain in the period due to the strengthening of the South African Rand.

- Net income attributable to equity shareholders was $2.6 million in YTD 2024 compared to net income attributable to equity shareholders of $7.3 million ($0.05 earnings per share) in YTD 2023. The decrease of YTD 2024 net income was mainly attributable to lower gross margins earned on year-to-date chrome sales offset by a decrease in finance costs.

- The Company had a working capital deficit (current assets less current liabilities) of $17.0 million as at June 30, 2024 (December 31, 2023 – working capital deficit of $15.5 million) and short-term cash resources of $17.4 million (consisting of cash, cash equivalents and short-term investments) (December 31, 2023 – $21.3 million).

Wanjin Yang, Chief Executive Officer and President of Eastplats commented, “We continue to focus our efforts on ramping up production in the Zandfontein underground section at the Crocodile River Mine and expect to process the run-of-mine ore soon.”

Operations

Year-over-year production decreased between Q2 2023 and Q2 2024 due to inclement weather and operational challenges incurred in the current period, as lower grade sections of the TSF, containing vegetation and other impediments, were being processed.

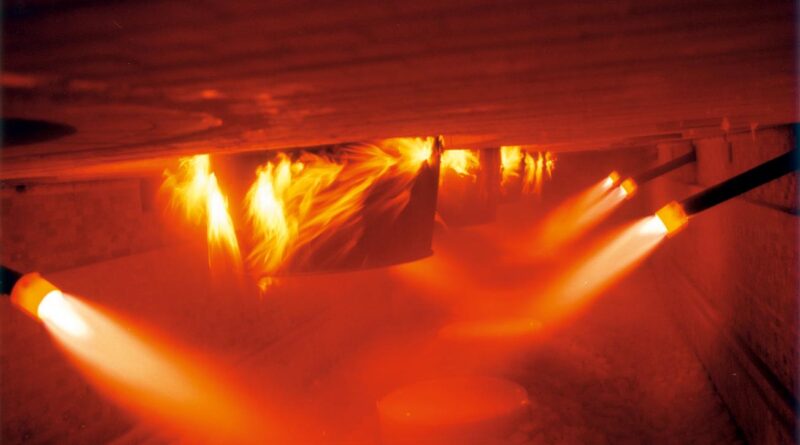

As the end of the Retreatment Project approaches, Eastplats continues underground blasting activities at the CRM and started to raise and stockpile run-of-mine (“ROM”) ore at the surface for processing. The commissioning of the processing plant is expected to be completed by the end of August or early September of 2024, which will mitigate revenue decreases at the CRM. At the normalized run rate, this soft restart phase is expected to produce 40,000 tons of ROM ore per month for processing by the end of 2024. The next phase will see operations ramp up to 70,000 tons of ROM ore for processing by the end of 2025, operating at a steady state rate of 70,000 to 80,000 tons monthly by 2026.