Expanded Oropesa Tin ticks all the boxes

Elementos has announced that the planned tin operation at its Oropesa project will now be significantly larger than previously thought, based on the results of its Optimisation Study.

Elementos acquired the Oropesa project, located in the Andalucia region of southern Spain, in 2020. The company published an Economic Study of the proposed mine that year, using available data, but the tin market has changed significantly since then. In the last year, tin prices have nearly doubled, as have the project’s Mineral Resources.

As a result of the recent developments, the company felt that it was necessary to re-evaluate the proposed Oropesa mine before finalising everything in its announced Definitive Feasibility Study (DFS).

At a high level, much of the project remains unchanged. The mine will still be an open pit and the operation will use much the same processing flow as detailed in the company’s 2020 Economic Study. However, the scale has increased based on the 50% larger Mineral Resources and tin prices. The strip ratio has materially reduced (from 11.7x to 8.8x), the benefit of shallower ore being quantified in the 2021 Mineral Resource Estimate. Additionally, the layout of the mine has been re-designed to minimise disturbance to any sensitive environmental areas.

Previously, the company planned to mine some 750ktpa of ore; this has increased by two-thirds to 1.25Mtpa. The new open pit was designed with revenue in mind, using a base case tin price of US$ 32,500/tonne. In this scenario, production would last for roughly 13 years. But, if prices remain higher, Elementos could expand the open pit adding another two years to the life of the mine – with the expansion conveniently located at the end of the mine life.

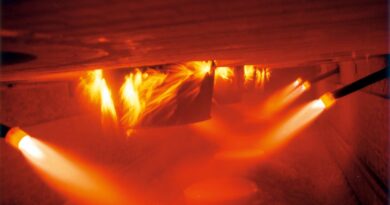

Feed from the mine will run through a relatively unchanged processing plant. The processing plant will recover some 74% of the contained tin in the ore, rejecting waste via ore sorters and minor stannite (3%) during sulphide flotation.

As a result, Oropesa should produce some 5,400 tonnes of a 62% tin concentrate annually. This is equivalent to 3,350 tonnes of tin, up from 2,440 tonnes in the previous study.

From a financial view, the expanded mine looks set to benefit almost every metric. Although costs are higher in the latest study, this is mostly due to the increased scale of the mine and range of estimated costs. Depth and distance sensitivities to mining costs, discrete dewatering costs, and rates for grade control drilling have helped increase the cost accuracy.

The major change to the costs, however, is the full rehabilitation of the open pit. In an attempt to more than comply with Andalucian regulations, Elementos has matured its plan for tailings and rehabilitation at Oropesa. Rather than having much of the waste remain on the surface – as was the previous plan – Elementos will now back-fill the mine pit, as well as cap the tailings dam and remove all surface infrastructure. Therefore, only a minimal waste pile and a capped tailings dam will remain after mining, with additional rehabilitation work also factored in. While the cost is higher, the environmental benefits are material.

The additional costs are more than compensated for in revenue. The Optimisation Study indicates annual revenues of US$ 108 million, 125% higher than estimated for the previous mine design.

Over the coming years, the tin market is still likely to experience a shortfall in production compared to forecasted demand levels. Increased planned output from a likely new source of tin will help to move the market closer towards balance.

Elementos’ new study has re-confirmed the feasibility of the Oropesa project as a relatively near-term producer of tin. The project was recently added to the Andalucian Government’s Project Accelerator Unit, a significant vote of confidence in the mine by the local authorities.

Now, the company is progressing towards a Definitive Feasibility Study (DFS). The DFS will incorporate this study, along with updated representative metallurgical testing (underway), and more mature studies into mine design and processing. The company will be basing all regulatory submissions (planned for early April 2022) on the Optimisation Study- however depending on further drilling results, the company may look to expand the proposed mine, given the expansion potential highlighted recently.