Gemfields returns to strong operational and financial performance

LONDON – After what has been a challenging 18 months for most businesses, the second quarter of 2021 has provided grounds for positivity for Gemfields Group. Stronger than anticipated auction results arose thanks to a marked increase in market demand and the consequential rise in the prices realised.

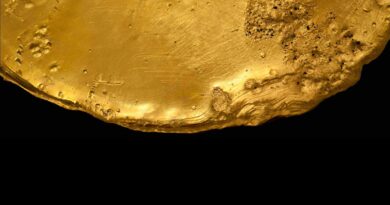

Gemfields’ strategy remains focussed on consolidating its position as a world-leading supplier of responsibly sourced African emeralds, rubies and sapphires.

The step-change in market action was accompanied by the simultaneous reopening of Gemfields’ mining operations. Gemfields’ teams worldwide have made notable sacrifices to safeguard the business through the difficult and unprecedented time preceding the April 2021 auctions, including salary sacrifices.

Their flexibility and innovation in navigating ever-changing circumstances stand the Group in good stead should similar extraordinary events occur in the future. Gemfields’ strategy remains focussed on consolidating its position as a world-leading supplier of responsibly sourced African emeralds, rubies and sapphires, with the ownership of the iconic Fabergé brand enhancing the positioning and perception of coloured gemstones in the minds of consumers.

Overall, Gemfields generated group-wide revenues of USD97.2 million with EBITDA of USD43.5 million (six months to 30 June 2020: revenues of USD15.0 million and an EBITDA loss of USD24.7 million).

The Group’s net profit after tax of USD23.8 million and Free Cash Flow (as defined in the Financial Review) of USD48.3 million were aided by the lower-than-average operating costs in the first quarter of the year due to the suspension of the Group’s mining operations and the temporary cutbacks in corporate costs.

Normalised earnings for the year, after removing fair value movements in Sedibelo, but not adjusting for the assorted operating cost savings in the first quarter of 2021, yields a net profit after tax of USD16.1 million (six months to 30 June 2020: USD32.7 million loss, which also excluded the Fabergé impairment loss). At 30 June 2021, the Group was in a net cash position of USD28.7 million (31 December 2020: net debt of USD12.6 million) and held a gross cash balance of USD67.3 million.

Sean Gilbertson, CEO of Gemfields, commented: “We are delighted to announce our return to strong operational and financial performance after the Covid-induced horrors of 2020. These results are a testament to the hard work put in by our teams in the first six months of the year, including their textbook re-opening of the world’s largest emerald and ruby mines which produced no new gemstone supply for a year given the need to preserve cash in the wake of the pandemic. With the mines back in full-swing, a much-improved cash position and the step-change in market demand we’ve witnessed in our recent auctions, we are palpably excited about the remainder of 2021.”