Gold Fields moves away from labour-intensive mining to mechanised operations

JOHANNESBURG – Gold Fields, in an operational update for the quarter ended 31 March 2021, says notwithstanding the impact of COVID-19 on Q1 2021 (particularly impacting Cerro Corona and South Deep), Group attributable equivalent gold production was 541koz, largely flat YoY (down 9% QoQ).

Group production remains on track to deliver the guidance provided in February 2021. Group AISC for the quarter was US$1,078/oz, up 11% QoQ and YoY. AIC for the Group was US$1,249/oz, 18% higher YoY (up 12% QoQ) as capital expenditure at Salares Norte starts to ramp up.

Net debt at the end of the quarter was US$1,224m, compared to US$1,069m at the end of December 2020, primarily driven by the payment of the final dividend of US$190m. The net debt to EBITDA at the end of the quarter was 0.59x, largely unchanged QoQ. The balance sheet remains in a strong position.

During 2020 Gold Fields operations spent approximately US$30m on COVID-19 related initiatives and interventions such as specialised camp accommodation, testing equipment and facilities, additional labour costs and transport facilities.

A further US$3m was spent on donations to assist governments and communities in their fight against the pandemic. In Q1 this year the respective figures were US$6.3m and US$280,000.

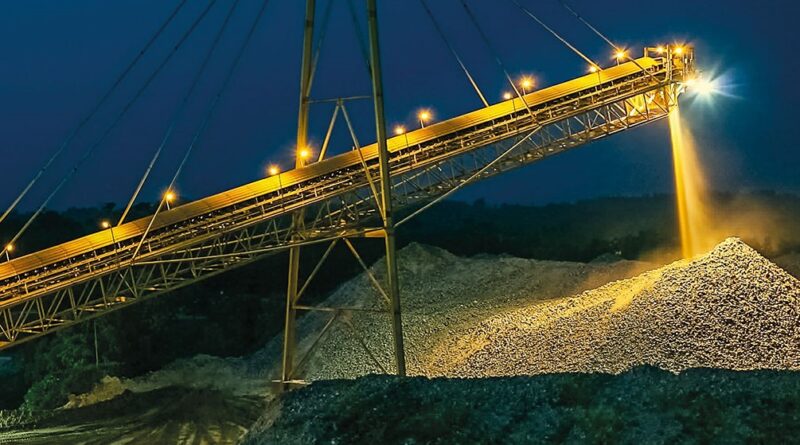

Newly appointed CEO of Gold Fields, Chris Griffith said: “Being in the seat for 36 days, confirmed my expectations that Gold Fields is well on its way to being a global leader in sustainable gold mining. The deliberate strategy of moving away from labour-intensive, conventional mining to focus on mechanised open pit and underground operations, with majority international exposure, has served the company well.

“In addition, the reinvestment programme over the past four years has placed Gold Fields in a position where it can maintain and even grow its production profile over the next decade. Salares Norte is indeed a world class project and delivering the project on time and on budget is one of the key focus areas in the coming years. Our ESG work continues to evolve and we remain on track to provide more definitive targets for our key ESG priorities by year-end.

“Our operations are also starting to work closely with their respective governments on the rollout of vaccines, not just to employees and contractors, but also to communities. In the countries that we operate, mining has been classified as an essential service which means that our employees will be among the earlier groups to receive vaccinations.

Q1 2021 OPERATIONAL PERFORMANCE

The Australian region produced 236koz at AIC of A$1,529/oz (US$1,181/oz) and AISC of A$1,442/oz (US$1,115/oz).

Gold Fields mines in Ghana produced 221koz (including 45% of Asanko) at AIC of US$1,078/oz and AISC of US$1,038/oz.

Production at Cerro Corona in Peru was impacted by unusually high rainfall during the March quarter, with the mine producing 46koz (gold equivalent) at AIC of US$1,160 per gold equivalent ounce and AISC of US$1,067 per gold equivalent ounce.

Despite the second wave of COVID-19 that affected South Africa during December 2020 and the early parts of 2021, production at South Deep was only marginally lower YoY. The mine produced 60koz during the first quarter at AIC of R694,685/kg (US$1,444/oz) and AISC of R667,614/kg (US$1,388/oz).

Encouragingly, productivity trends continued to improve across key leading indicators during the quarter, with stoping productivity being the focus area for improvement over the remainder of the year.

FY 2021 GUIDANCE UNCHANGED

As previously guided, 2021 is a high capital expenditure year for Gold Fields (US$1.177bn). Two additional projects were approved post quarter end:

- the development of the Huni Pit at Damang, which adds incremental production to the project and provides flexibility on the mining front, at a cost of US$43m, with approximately US$15m to be incurred in 2021; and

- the solar plant at South Deep, with R318m (US$21m) capex being incurred in 2021.

Despite this additional expenditure, Gold Fields maintains its cost guidance provided in February 2021. For 2021, attributable gold equivalent production is expected to be between 2.30Moz and 2.35Moz.

AISC is expected to be between US$1,020/oz and US$1,060/oz, with AIC expected to be US$1,310/oz to US$1,350/oz. If the accountants exclude the very significant project capex at Salares Norte, AIC is expected to be US$1,090/oz to US$1,130/oz. The exchange rates used for the 2021 guidance are:

R/US$15.50 and US$/A$0.75.

Group production guidance also remains unchanged, however two mines within the group have been impacted by COVID-19 during Q1 2021. As a result, production at South Deep is expected to be 300kg (9.3koz) lower at 8,700kg (280.0koz).

Gold production at Cerro Corona is expected to be 20koz lower at 110koz, with copper production remaining at similar levels. However, the higher copper price has more than offset this impact on a gold equivalent ounce basis. Consequently, Group guidance remains intact.