Gold Fields: South Deep had an exceptionally good quarter

JOHANNESBURG – Gold Fields in its operational update for the quarter ended 30 September 2021 said Gold Fields had a solid September 2021 quarter, with attributable gold equivalent production for Q3 2021 of 606koz, up 9% YoY (up 8% QoQ).

South Deep in particular had a good quarter, with production up 30% QoQ. All-in cost (AIC) increased by 18% YoY (down 3% QoQ) to US$1,263/oz largely due to the capital expenditure at Salares Norte increasing from US$23m to US$108m, while all-in sustaining costs (AISC) increased 5% YoY (and decreased 8% QoQ) to US$1,016/oz.

AIC would have increased by 3% to US$1,050/oz from US$1,024/oz if the significant project capex at Salares Norte and the appreciation of the Australian Dollar and South African Rand are excluded.

The Australian region produced 256koz at AIC of A$1,499/oz (US$1,102/oz) and AISC of A$1,386/oz (US$1,018/oz). Its mines in Ghana produced on a managed basis 214koz (including 45% of Asanko) at AIC of US$1,097/oz and AISC of US$1,072/oz. Cerro Corona in Peru produced 69koz (gold equivalent) at AIC of US$951 per gold equivalent ounce and AISC of US$805 per gold equivalent ounce.

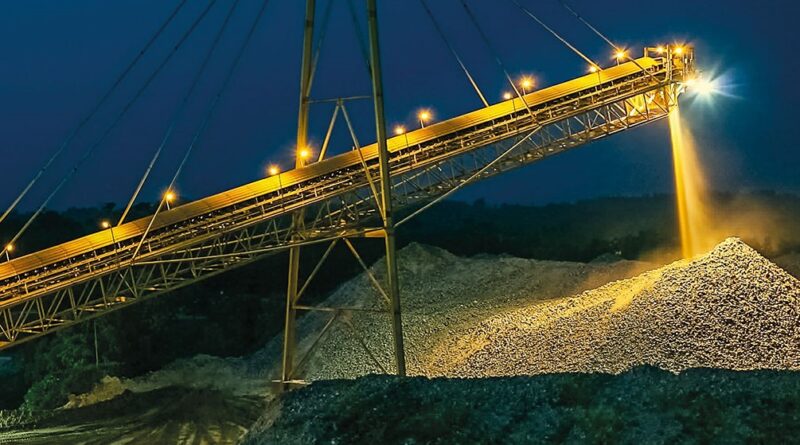

South Deep had a good September 2021 quarter, with managed production of 88koz at an AIC of R567,550/kg (US$1,208/oz) and AISC of R542,660/kg (US$1,155/oz). South Deep remains on track to meet the revised guidance provided with the Q1 2021 operating update, despite certain maintenance activities planned in Q4 2021.

Gold Fields remains in a strong financial position. During Q3 2021, there was a further decrease in the net debt balance (including leases) to US$1,037m at 30 September 2021 from US$1,097m at 30 June 2021, even after taking into account the interim dividend payment of US$132m.

This translates in a net debt to EBITDA of 0.44x, compared to 0.49x at 30 June 2021. The net debt balance (excluding leases) decreased to US$620m from US$663m at the end of June 2021.

SALARES NORTE

The critical path of the project remains on track, although Q3 2021 was again impacted by severe winter weather (in the early part of the quarter) as well as ongoing COVID-19 constraints. Given the COVID-19 and weather impacts it is unlikely that the project will achieve the previously guided 65% completion milestone by the end of 2021 and should see completion of around 62% by year end.

Importantly, all the critical path items are tracking plan. In addition, more than 95% of imported components have arrived in Chile, so the project is not expected to be delayed by shipping constraints currently being experienced globally.

The project remains on track to deliver first gold by the end of Q1 2023. Mining and exploration were the standouts for the quarter, with both activities outperforming the plan for the quarter.

ON TRACK TO MEET 2021 GUIDANCE

FY 2021 production and cost guidance, as provided in February 2021, remains intact. Attributable gold equivalent production is expected to be between 2.30Moz and 2.35Moz. As previously guided, AISC is expected to be between US$1,020/oz and US$1,060/oz, with AIC expected to be between US$1,310/oz to US$1,350/oz.

If the very significant project capex at Salares Norte is excluded, AIC is expected to be US$1,090/oz to US$1,130/oz. The exchange rates used for the 2021 guidance are: US$/R15.50 and US$/A$0.75.