India to become world’s largest metallurgical coal importer

Canberra – Department of Industry, Science, Energy and Resources Australia in its Resources and Energy Quarterly March 2021 has highlighted that world’s second largest steel producer and second biggest metallurgical coal buyer India is estimated to have imported 54 million tonnes in 2020, down from 58 million tonnes in 2019, reflecting the effects of the COVID-19 pandemic on Indian steelmaking.

However, as Indian steelmaking gradually emerged from the worst effects of the pandemic, imports lifted in the second half of the year. India has released plans to increase its crude steel production capacity from 142 million tonnes to 300 million tonnes per year by 2030.

This will place pressure to increase imports given India’s limited domestic reserves of metallurgical coal. With steelmaking a key priority in India, it is projected that India’s metallurgical coal imports will increase from 54 million tonnes in 2020, to 65 million tonnes by 2022 and 80 million tonnes by 20262025 and surpassing China, India will become world’s largest importer of coking coal in 2023.

World metallurgical coal trade fell by 40 million tonnes, or around 13% in 2020. This was in large part due to the effect of the COVID-19 pandemic and associated containment measures, which severely affected industrial production and steelmaking across most countries.

Most steelmaking now occurs in Asia, and while Chinese steelmaking remained strong, there were sharp falls in metallurgical coal demand in India, Japan, South Korea, and Russia. A gradual easing in COVID-19 containment measures late in 2020 led to some recovery in steel production outside China, which in turn led to a broadly based rise in metallurgical coal imports in late 2020 and early 2021.

However, steel output in China continues to lead the world, with China’s steel industry recording strong growth in 2020 as a result of stimulus measures. This has resulted in an atypically China-centered metallurgical coal market at the start of 2021.

World trade in metallurgical coal is expected to recover and rebalance over the remainder of 2021 and 2022 as industrial production outside of China returns to normal levels. Metallurgical coal markets are expected to grow most rapidly in India, and more slowly in Japan, South Korea and Europe.

China, where output grew in 2020, is expected to remain largely stable in its use of metallurgical coal as steel demand gradually peaks over the next few years and alternative forms of steelmaking (notably through scrap steel) increase in importance.

On balance, it is expected that metallurgical coal has a stronger recovery prospect than thermal coal, which faces a range of technological and policy headwinds. The divergence in outlook is particularly apparent in the US, where steelmaking remains a key priority while power companies have continued to retire their aging thermal coal capacity in the face of tighter air emissions standards and deteriorating cost competitiveness.

China’s imports are leveling off in the early part of 2021 China is the world’s largest steel maker and largest metallurgical coal buyer, importing around 73 million tonnes of metallurgical coal in 2020.

Imports to China remained strong through much of 2020, despite some easing late in the year. Imports from Russia increased in late 2020 as China sought alternatives to Australian product.

Chinese metallurgical coal imports are forecast to ease over the outlook period as the country builds its scrap steel industry and improves its domestic output. Imports are expected to ease to 69 million tonnes in 2022 and to 64 million tonnes by 2026.

Japan’s imports to fall, while South Korea’s to rise slightly after 2020 Japan is the world’s third largest metallurgical coal importer, importing 40 million tonnes in 2020. This was down from 43 million tonnes in 2019, though the December quarter results show clear signs of strengthening.

With two major producers planning to retire some steelmaking capacity over the outlook period, Japan’s metallurgical coal imports are not expected to fully recover to their pre-COVID levels, remaining largely steady at just over 40 million tonnes annually over the outlook period. South Korea is the world’s fourth largest metallurgical coal importer, buying 33 million tonnes in 2020. This is around 10% below the level of 2019, but some recovery is expected in 2021, with imports projected to reach 38 million tonnes by 2026.

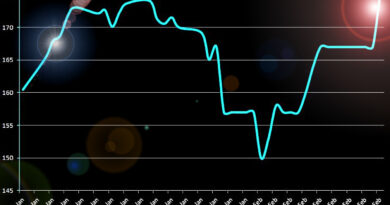

Australia is the world’s largest exporter of metallurgical coal, accounting for around half of global seaborne supply. Australian metallurgical coal exports are expected to fall to 173 million tonnes in 2020-21, largely due to China’s informal restrictions on imports of Australian coal persisting into 2021.

Some of this loss is likely to be offset by rising exports to India, Bangladesh, Pakistan and the Middle East, with newly formed supply chains expected to persist through the outlook period. The most significant shift in supply chains is likely to take place between Australia and Mongolia.

Australia was the largest exporter to China over the first half of 2020 as China closed its border with Mongolia due to COVID-19. This shift reversed late in the year as China imposed informal import restrictions on Australian coal and resumed trade with Mongolia.

Metallurgical coal prices have become two-tiered’, with Chinese import restrictions reducing the price of Australian output relative to output sourced elsewhere. However, prices for Australian output showed signs of recovery in January-February, amidst concerns over potential summer weather disruptions and market speculation around a potential easing in Chinese import restrictions.

US export volumes have plunged, and are likely to stay down The US has long been the world’s second largest exporter of metallurgical coal after Australia. However, its exports plunged sharply (from 50 million tonnes to 37 million tonnes) in 2020.

Exports from the United States were hit particularly hard as its largest buyers (especially Brazil and the EU) cut their steel production. Coal production in the US occurs largely inland, resulting in relatively high transportation and production costs, which make it hard for the US to redirect to more distant markets.

Exports from the US are expected to continue struggling over the outlook period, as Brazil and Europe face a slow (and potentially incomplete) recovery in steelmaking. US metallurgical coal exports are expected to contract over the longer term due to high costs and a long-term reduction in steelmaking capacity across Europe.

Russian exports are estimated to have fallen by 10% in 2020, to around 23 million tonnes. However, exports strengthened in the second half of the year, and are expected to recover to 24 million tonnes by 2021, growing gradually over the rest of the outlook period to reach 32 million tonnes by 2026.

Russian coal is extremely low in sulphur, making it suited for emerging Asian markets where pollution laws are becoming more stringent. Russia is also investing significantly in new mining capacity, and rail/port expansions, which should improve cost competitiveness and increase access to buyers in the EU and South Asia.

Mongolia’s exports remain subject to conditions in China Mongolian exports are estimated to have fallen by around 15% in 2020, largely due to COVID-19 containment measures impacting exports to China.

Mongolian exports have subsequently recovered with the resumption of normal trade, and are expected to resume at pre-COVID-19 levels (around 30 million tonnes per year) from 2021. Exports are then expected to increase over the outlook period, reaching 32 million tonnes by 2026.

Exports will be supported by recent tariff cuts in China under the Asia-Pacific Trade Agreement and by the completion of a key railway connecting mines in Mongolia with buyers in northern China.

Exports from Canada could partly fill China’s Australia gap Canada exported 31 million tonnes of metallurgical coal in 2020, around 10% below its typical export levels. However, only around 10% of this was shipped to China, leaving Canada relatively exposed to the weakness of non-Chinese markets.

Exports to China are now increasing as Canadian production is drawn to the fill the space created by China’s informal import restrictions on Australian coal.

Canada’s metallurgical coal exports are expected to lift temporarily to 32 million tonnes in 2020, though in the longer term its relatively high production costs and long shipping routes are projected to see its exports edge down to 29 million tonnes by 2026.

Mozambique currently has two exporting metallurgical coal mines: Vale’s Moatize project and Jindal Steel’s Songa project. Mozambique’s exports fell sharply in 2020, as low prices heavily affected the country’s relatively high cost producers.

A recovery is expected over the next few years, with output forecast to reach 7 million tonnes in 2022 and 12 million tonnes by 2026. The rise is expected to be driven in large part by the ramp up of Vale’s Moatize mine, and facilitated by the 912 kilometer Nacala logistics corridor rail line and Nacala port expansion.