Lonely manufacturer of spherical graphite outside China

As already reported, Syrah Resources has gone further than any graphite developer outside China in its attempt to develop an integrated Rest-of-World (ROW) supply chain. It has completed its new bankable feasibility study to add 10ktpy of lithium-ion battery anode material capacity to its US operation.

A number of other developers have also carried out their own feasibility studies on spherical graphite, Syrah Resources is the first to build such a plant, then look to go even further downstream.

Roskill predicts that the battery/EV industry is poised to return to burgeoning growth rates in the coming years, creating a myriad of opportunities for new players based on surging demand throughout the graphite supply chain; however, there remain a number of hurdles for any company looking to break into an industry that is so heavily dominated by China.

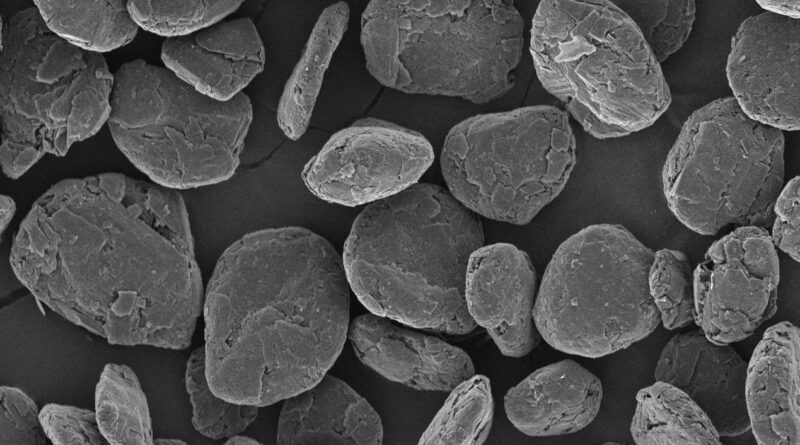

While graphite production itself is more diversified, production of the intermediate, spherical graphite has, traditionally, only taken place in China; although Syrah Resources began to produce its first purified product of battery grade in July this year and has been ramping up.

A non-Chinese source may be attractive to global manufacturers of anode materials (led by China but with significant volumes produced in Japan and elsewhere) and offer a more sustainable alternative using low/non-hydrofluoric acid (HF), in contrast to high HF use in around 80% of the current standard Chinese production routes. Roskill’s 2020 report analyses the cost structure of the different routes to production and offers a cost curve for the main producers.

However, it has long been unclear if anode material producers would be willing to pay a potential premium for more sustainable ROW spherical graphite.

Syrah Resources’ push to produce anode material itself in house may be a more attractive route to market, if it can forge deals directly with the anode/battery makers. Meanwhile, the vast majority of anode/battery manufacturers are located in China, close to domestic supply routes, and China continues to increase its market share.

Syrah Resources also already has its own large-scale graphite mine but this is currently under temporary closure and saw a two thirds cut in production from Q4 2019 on low demand. The company was looking to improve recoveries and decrease production costs at the mine prior to this closure.

It is unknown what future production rates may be when the mine does reopen. The refocus on added-value downstream anode material production, currently based on toll processed spherical graphite, would be one way to improve margins.