Newmont Defers Investment Decision for Yanacocha Sulfides Project to Advance Portfolio Optimization Strategy

DENVER – Newmont Corp. has announced it will defer the full-funds investment decision for the Yanacocha Sulfides project in Peru (the Project) for at least two years to advance its portfolio optimization strategy designed to maximize returns for shareholders and create long-term value for other stakeholders. The decision positions Newmont to prioritize other value-accretive opportunities and support its disciplined capital allocation strategy, which balances steady reinvestment in the business, maintaining financial strength and flexibility and providing leading returns to shareholders.

“Once complete, our proposed acquisition of Newcrest will create an industry-leading portfolio of Tier 1 operations and deepen our unmatched pipeline of value-accretive projects,” said Tom Palmer, President and CEO of Newmont. “In connection with this transaction and our strategy to create lasting value, we are targeting at least $2 billion in near-term cash flow improvements through portfolio optimization within the first two years. The deferral of the Yanacocha Sulfides project represents the first step in delivering on this target, as we evaluate further opportunities to resequence project capital and rationalize the combined portfolio to build a more profitable and resilient future for the business.”

The deferral of the full-funds investment decision results in a reduction of development capital expenditures, including an estimated $300 million included in Newmont’s outlook for 20242. The decision to defer the Project is based on a robust analysis led by Dean Gehring, Chief Development Officer – Peru, over the last nine months to further maximize the Project’s economics in a period of high global inflation and market volatility. This analysis and investment to date will be integral to preparing for a full-funds decision, and will continue to support the Project when construction resumes.

Mr. Palmer continued, “Newmont has a long history of operating in Peru, and Yanacocha is core to Newmont’s portfolio and long-term strategy. With the potential to operate as a Tier 13 gold and copper mine for several decades, we remain committed to managing Yanacocha’s operations and closure activities safely and responsibly. We will continue to work closely with government stakeholders, business partners and local communities in Peru as we prepare for a future investment decision on the Sulfides Project.”

Dean Gehring will now shift his focus from leading the Yanacocha operation and Sulfides project to leading integration planning for Newmont’s proposed acquisition of Newcrest. In this role as Chief Integration Officer, Dean will lead key activities required for a safe and smooth integration, while setting up the organization for ongoing success.

The Yanacocha Sulfides Project

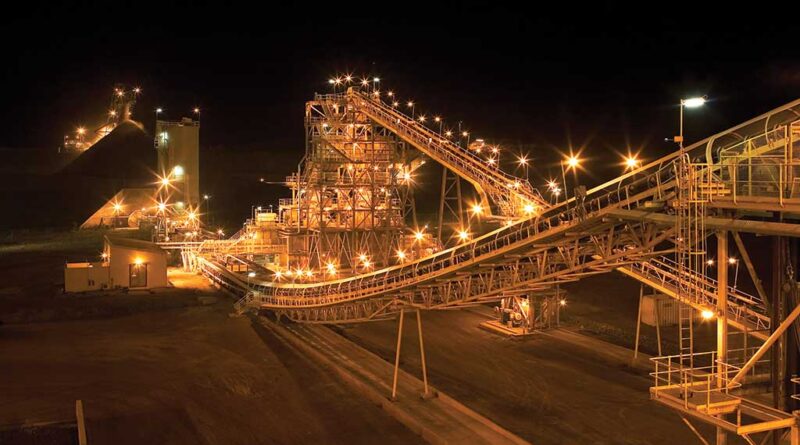

The Yanacocha Sulfides project aims to develop the first phase of sulfide deposits at Yanacocha through an integrated processing circuit, including an autoclave to produce 45 percent gold, 45 percent copper and 10 percent silver. The first phase focuses on developing the Yanacocha Verde and Chaquicocha deposits to extend Yanacocha’s operations beyond 2040, with second and third phases having the potential to extend the operation’s life for multiple decades.

ABOUT NEWMONT

Newmont is the world’s leading gold company and a producer of copper, silver, zinc and lead. The Company’s world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in North America, South America, Australia and Africa. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social and governance practices. The Company is an industry leader in value creation, supported by robust safety standards, superior execution and technical expertise. Newmont was founded in 1921 and has been publicly traded since 1925.