Platinum Market to reach record 1-million ounce deficit in 2023

The platinum market has been fairly dull through most of 2023 as prices trade in a broad $100 range between $900 and $1,000 an ounce; however, the latest research from the World Investment Platinum Council shows the market is starting to heat up as the precious metal could see a record deficit this year.

In its second-quarter market report, the World Investment Platinum Council said platinum could see a deficit of 1 million ounces, “the largest deficit on record in terms of both absolute ounces and as a percentage of annual demand,” the report said.

In an interview with Kitco News, Edward Sterck, director of research at the WPIC, said that an exciting feature about the platinum’s record imbalance is that it is driven by solid demand growth even as supply remains constrained.

“Demand is up 27% year on year, which is significant, especially given, the kind of economic overlay we are experiencing,” he said.

According to the report, demand is being driven by consumption in the automotive sector. Platinum is a critical element in catalytic converters, which are used to reduce harmful emissions in diesel and gasoline-powered engines.

“Platinum automotive demand rose 19% year-on-year (+136 koz) to 840 koz in Q2’23, as the semiconductor shortage continued to ease, leading to a healthy uplift in vehicle production,” the report said.

Sterck said that automotive demand has been driven by increased production as the microchip shortage continues to ease. At the same time, the sector continues to see more substitutions as automakers use cheaper platinum over more expensive palladium. Sterk added that tighter emission standards in China mean automakers are increasing the amount of the precious metal used in catalytic converters.

However, the auto sector is just one pillar of the platinum market that is seeing increased demand. Sterk said that industrial demand, driven by glass manufacturing and chemical production, have consumed more platinum this year.

“Industrial platinum demand totaled 697 koz in Q2’23, a 12% increase year-on-year and its highest level since Q3’21,” the report said.

Another important pillar of platinum demand is the investment market, which Sterck said remains relatively consistent as the market sees solid inflows into platinum-backed exchange-traded products.

“Platinum ETF holdings grew by 155 koz in Q2’23, their largest quarterly increase since Q3’20 and up 196 koz since the start of the year, with significant renewed interest from South African funds. However, overall ETF holdings are expected to soften during the rest of 2023,” the analysts wrote in the report. “Despite a fall in global bar and coin investment to 26 koz (-64%, -46 koz) in the second quarter, full-year 2023 is likely to see a year-on-year jump of 45% (+102 koz), to 326 koz, the first growth in bar and coin investment in three years, driven by a return to positive net platinum investment in Japan.”

The platinum market has seen fairly volatile supply and demand fundamentals; however, Sterck noted that what makes the current deficit trend more sustainable is the fact that supply continues to be an issue.

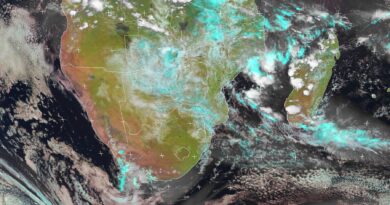

South Africa, the world’s largest PGM producer, has seen is platinum production curtailed this year as the nation deals with an unprecedented energy crisis. Platinum producers have had to adjust their output in the face of rolling blackouts nationwide.

“Refined mine production declined 4% (-65 koz) year-on-year in Q2’23, totaling 1,464 koz, as increases from North America and Russia were heavily outweighed by a decline from South Africa. Following three consecutive quarters of declining supply, South African output improved this quarter, reaching 1,028 koz. Nevertheless, this was still a 9% decline (-101 koz) year-on-year, primarily due to processing-asset maintenance in addition to disruption due to Eskom load curtailment,” the report said.

Sterck said it’s difficult to say when South Africa will see full platinum production. Some analysts expect the nation’s power issues won’t be resolved until 2025.

Trevor Raymond, CEO of the WPIC, said in a statement that the platinum market has been building a solid foundation this year.

“Looking beyond today’s Platinum Quarterly, our research shows that automotive and industrial demand growth underpin total demand growth in 2024 and beyond. This offers both short and long-term value incentives for investors, as well as protection from downside risks presented by inflationary headwinds and high interest rates.”

With platinum expected to see sustainable annual deficits, the question many investors keep asking is when prices will break out.

Sterk said that the market continues to suffer from a lack of a catalyst as investors and trading algorithms have become complacent. He pointed out that it’s been almost automatic that investors buy around $900 an ounce and sell around $1,000 an ounce

“If the market can break out of this range, we would expect to see a surge in investor demand,” he said.