Sibanye-Stillwater profit drops in Q3, due challenging economic environment

Sibanye-Stillwater has reported that production from its gold operations in South Africa (including DRDGOLD) was 197,663 oz in Q3 2023, down 3% compared to Q3 2022.

The company’s platinum group metals (PGM) production from its operations in South Africa was 475,555 4Eoz (including third party purchase of concentrate) in Q3 2023, 6% higher compared to Q3 2022, primarily due to third party purchase of concentrate processing increasing by 44% to 23,995 4Eoz year-on-year.

Mined 2E PGM production from the company’s US PGM operations was 105,546 2Eoz in Q3 2023, 23% higher than in Q3 2022, which was impacted by the regional flooding in Montana in mid-June 2022.

The company said that its US PGM operations resume planned mine production run rate in October 2023 driving improved outlook for production for Q4 2023.

Sibanye added that at its US PGM recycling operations, recycling ounces fed an average of 9.5 tonnes per day for Q3 2023, 46% lower than for the comparable period in 2022. During Q3 2023, 873 tonnes of material was processed, 46% lower than Q3 2022.

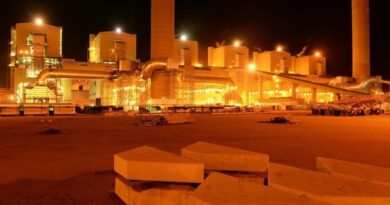

The company noted that despite the improved operational performance, the Sandouville nickel refinery (France) remained loss making, due to continued inflationary cost pressures, elevated maintenance costs and a further decline in the average nickel price.

According to the company, its Century zinc retreatment operation in Australia contributed positive adjusted EBITDA of $3 million in Q3 2023, successfully recovering post regional flooding during Q1 2023.

The company said that construction of the Keliber lithium project in Finland is progressing well, adding that construction has commenced at the concentrator and the first open pit.

Sibanye-Stillwater also reported Q3 2023 group adjusted EBITDA of $163 million, which is a decline of 67% compared to Q3 2022 ($496 million).

“The global macro-economic environment remains challenging, and we continue to assess the positioning of our operations for optimal performance and sustainability through the cycle,” the company said in a press release.

The company also noted that it had recently announced a potential restructuring at its SA gold and SA PGM operations.

“Potential closure or rightsizing of high cost and underperforming shafts will ensure that operations remain profitable and sustainable at current precious metal prices and beyond, while retaining significant leverage to improvements in the commodity price outlook,” it said.

Sibanye-Stillwater is a multinational mining and metals company with a diverse portfolio of mining and processing operations and projects and investments across five continents. The company is also one of the foremost global PGM autocatalytic recyclers and has interests in leading mine tailings retreatment operations.