Silver to outperform other precious metals in 2021

After, precious metals had a spectacular year last year, and are geared for further gains in 2021. According to Reuters silver is tipped to outperform other precious metals. Experts are increasingly cautious about the prospects for gold as the global economy recovers from the impact of the coronavirus.

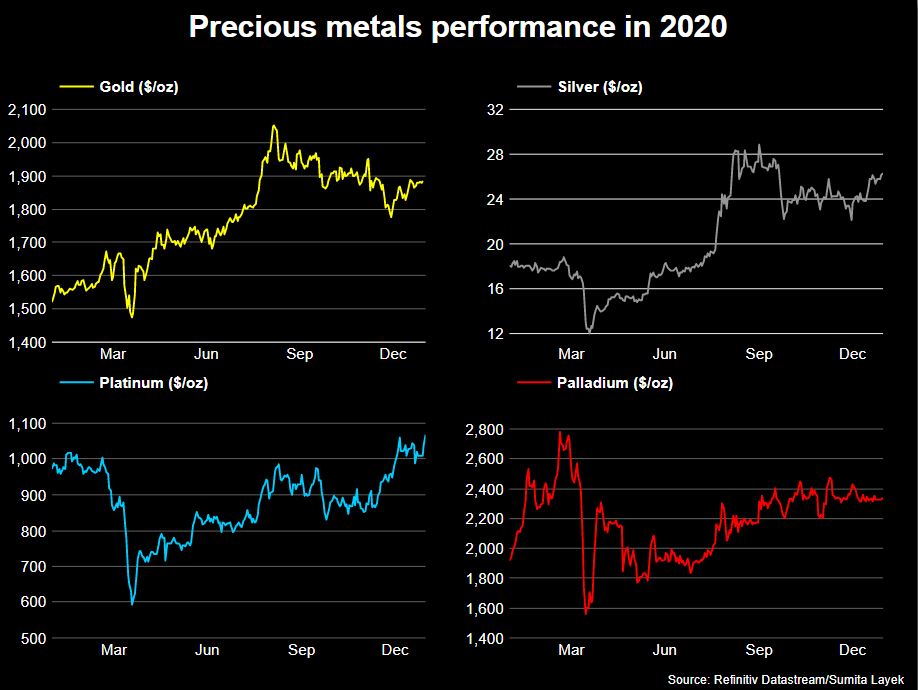

When pandemic began, investors started stockpiling gold and other precious metals in order to protect their wealth. This action, alongside supply deficits, moved gold and palladium prices up by more than 20% in 2020, while silver climbed 47%, and platinum 10%.

Philip Newman at consultants Metals Focus expects to see new record highs for gold and palladium in 2021. But he adds that silver will see the heaviest gains.

Customarily seen as a safe haven to store wealth, gold started to appreciate as economic growth slackened in 2019, but the pandemic fast-tracked the rally and in August 2020 prices hit a record high of $2,072.50.

Gold then plunged to around $1,900 as investors stopped buying and vaccines were deployed against the virus, encouraging investment in assets that perform well during periods of economic growth. Gold is seen by many experts to rise another 20% next year.

Also a safe-haven asset like gold, but also a metal used in industrial products, silver shot up from $18/oz in January 2021 to almost $30 in August before slipping to around $25.

Experts maintain its dual role and its greater volatility mean it could perform better than gold as economic growth picks up.

Investors grabbed up platinum that was in surplus, which has also industrial and jewellery applications. After an initial dip in March 2020, prices recovered to around $1,000 an ounce, slightly higher than at the start of the year.

The automotive industry uses four-fifths of palladium, which, neutralises engine emissions like platinum. Years of supply deficits drove prices to a record high of $2,875.50 an ounce in February 2020. The market thought it might run out of metal. Most forecasters expect supply deficits to continue in 2021 as the global economy revives and auto sales rebound.