Gemfields enacts actions to cut costs and streamline the business

As a result of the challenges in the emerald market, each of which management view as being transient, Gemfields is enacting Group-wide actions to cut costs and streamline the business. These actions include:

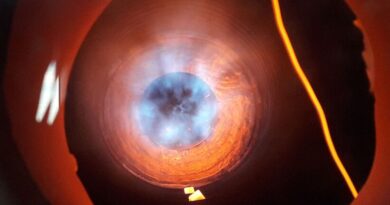

- suspending, for a period expected to be up to 6 months, all mining at Kagem Mining Limited (“Kagem”), the emerald mine in Zambia which is 75% owned by Gemfields. Instead, Kagem will focus on processing ore from Kagem’s significant ore stockpile utilising the recently upgraded processing plant;

- halting all non-essential spend and suspending planned capital expenditure at its ruby development assets in northern Mozambique, namely Megaruma Mining Limitada (“MML”) and Campos De Joia Limitada (“CDJ”). Eastern Ruby Mining (“ERM”) will continue core developmental work but will delay the capital expenditure associated with its originally planned processing plant;

- halting operations at Nairoto Resources Limitada (“NRL”), the gold project situated north of MRM and seeking potential buyers.

- assessing strategic options in respect of Fabergé, the iconic luxury-brand owned by the Gemfields Group; and

- targeted rationalisation of operations and businesses across the Group.

Gemfields continues to closely monitor its working capital as it navigates the prevailing challenges.

As stated in the 2024 Interim Report, management remains prepared to take additional cost reduction measures and pursue external funding options as may be required.