EU imposes antidumping duties against Chinese tinplate producers

The European Commission last week announced provisional antidumping duties against Chinese tinplate producers and against imports of PVC—a key tin chemical application—from Egypt and the United States.

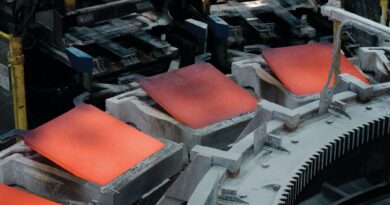

The Commission published preliminary results of its investigation into tinplate dumping in 2023 and 2024, so has imposed duties of 62.6% on Chinese companies and a lower rate for three individual companies.

European tinplate imports from China surged 73% in 2023 and increased again in 2024, approximately doubling the proportion of tinplate imports from China.

At the time, European tinplate producers expressed concern over the influx of Chinese tinplate, largely into Italy, although the effects of this have now mellowed and the industry is rebounding.

This decision from the EU to impose tariffs on tinplate follows similar decisions by Malaysia, Brazil, Indonesia, and the United States.

The European Commission also imposed tariffs on PVC ranging from 74.2% to 100.1% for imports from Egypt, and from 58% to 77% for imports from the United States. This follows an investigation that found imports from those countries between October 2022 and September 2023 were harming EU producers of PVC.

Tin is used in PVC stabilisers, representing the largest application for tin chemicals, which is the second largest tin use sector after solder.

One producer of PVC in Czechia, Spolana, announced in January it will cease production of a number of chemicals including PVC in 2025, citing macroeconomic pressures and high production costs in Europe reducing its competitiveness compared with the United States and Middle East.

These developments come as the latest wave of protectionist trade regulations amidst changing international trade dynamics. Weaker post-pandemic demand has put pressure on tin users, particularly in Europe, although the tide appears to be turning as the industry recovers from the demand trough.