First Quantum produced 4% less copper in Q4 2024

First Quantum reports that total copper production for the fourth quarter was 111,602 tonnes, a 4% decrease from Q3 2024 as a result of lower production at the Zambian operations. Copper C1 cash cost1 was $0.11 per lb higher quarter-over-quarter at $1.68 per lb, reflecting lower copper production volumes. Copper sales volumes totalled 111,613 tonnes, approximately 11 tonnes higher than production.

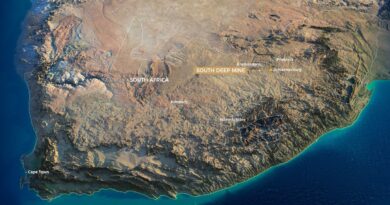

- Kansanshi reported copper production of 48,139 tonnes in Q4 2024, 1,671 tonnes lower than the previous quarter. While feed grades remained high with the continued swap of the mixed and sulphide mills, throughput was lower due to a planned maintenance plant shutdown in the sulphide and mixed circuits. Gold production continued to be strong with 29,787 ounces of gold produced in the fourth quarter. Copper C1 cash cost1 of $1.21 per lb was $0.08 lower quarter-over-quarter as a result of the drawdown of stockpiles. Production guidance for 2025 remains unchanged at 160,000 to 190,000 tonnes of copper and 100,000 to 110,000 ounces of gold. Copper and gold production in 2025 includes production associated with the Kansanshi S3 Expansion, with first production expected in the second half of 2025. The majority of the initial feed for S3 will be sourced from low-grade stockpiles.

- Sentinel reported copper production of 56,560 tonnes in Q4 2024, 1,852 tonnes lower than the previous quarter due to lower grades. Throughput levels, however, improved quarter-over-quarter with December 2024 reporting the highest monthly throughput since October 2022, benefiting from the development of Stage 3 (Western Cut-back) that increased availability of softer material, improved availability of the primary crushers and improved fragmentation of the ore. Stripping in Stage 4 (Final Eastern Cut-back) commenced during the fourth quarter. In-pit crusher 1 was successfully relocated and commissioned at the end of December, two months ahead of schedule. Copper C1 cash cost1 of $2.11 per lb was higher than the preceding quarter as a result of lower production volumes and higher tolling and freight costs. Copper production guidance for 2025 remains unchanged at 200,000 to 230,000 tonnes of copper. In 2025, the focus at Sentinel will be on increasing mill throughput with various ongoing initiatives in place to optimize blast fragmentation, maintain full stockpiles, and improve milling rates and flotation recovery. Grades are expected to be lower than 2024, in line with the pit development sequence. Stage 3 will supply a majority of the ore with lower volumes from Stage 1 and Stage 2 compared to prior years. The relocation of in-pit crusher 2 has been planned for the 2025 year, including installation of an innovative rail-driven conveyor system that is expected to result in reduced power and maintenance costs. A major overhaul is planned for a rope shovel during the second quarter. Stripping will continue in Stage 4, with ore expected to be available in 2026. Bringing forward production from Stages 3 and 4, along with a balanced increase in waste stripping, is expected to de-risk future ore supply to achieve an optimal and sustainable balance of grades and volumes during the life of the mine.

- For the fourth quarter of 2024, Enterprise produced 3,720 tonnes of nickel at a nickel C1 cash cost1 of $4.62 per lb. Sources of nickel sulphide ore during the quarter were impacted by weathering and alteration in a fault line in the Southern Wall of the pit and the presence of nickel silicates. In the second week of December, the Enterprise flotation circuit was switched to treat copper ores from the Sentinel mine while the fault area was mined through and the altered material was stockpiled separately for blending with fresh nickel sulphide ore. The relevant area in the Southern Wall was mined out in early January 2025 and nickel feed to the Enterprise concentrator resumed. 2025 Production guidance is 15,000 to 25,000 contained tonnes of nickel. The focus for 2025 at Enterprise will be on optimizing the development of the pit to supply feed volumes to the plant. Additional reverse circulation drilling will be performed to obtain additional geological information. Grade is expected to be lower than 2024 while recoveries will benefit from a better understanding of the geological characteristics of the ore.

- Production at Cobre Panamá has been halted since November 2023. During the quarter, the process plant assets inspection frequency was maintained at 56 days and the equipment start-up frequency remained unchanged at 14 days. In addition to asset preservation, a key focus continues to be on maintaining the environmental stability for all areas of the site and compliance with the environmental and social impact study for the project, which remains in force. Primary activities are in cleaning and maintenance works at sediment ponds, managing surface water at the waste dump and low-grade stockpiles, and treatment of water to manage the pH levels. Costs in the fourth quarter were approximately $13 million per month, which included labour, maintenance spares, contractors’ services, electricity, other general expenses, including the public outreach program across the country to enhance transparency and provide accessible information about Cobre Panamá. The Company is actively managing the maintenance costs of Cobre Panamá and will adjust the level of employment and the costs of these activities according to the conditions on the ground in Panama. Approximately 121 thousand dry metric tonnes of copper concentrate remain onsite following the 2023 disruptions at the Punta Rincón port. P&SM costs are expected to be between $12 million to $13 million per month.

2025 GUIDANCE

Production, C1 cash cost1and capital expenditure guidance for 2025 to 2027 remain unchanged from the News Release “First Quantum Minerals Announces 2024 Preliminary Production and 2025 – 2027 Guidance” dated January 15, 2025.

Interest expense on debt for the full year 2025 is expected to be approximately $600 million to $625 million and excludes finance cost accretion on related party loans to Cobre Panamá and Ravensthorpe, finance cost accreted on the precious metal streaming arrangement and on the Prepayment Agreement, capitalized interest expense and accretion on asset retirement obligation.

Cash outflow on interest paid is expected to be approximately $575 million to $600 million for the full year 2025. This figure excludes capitalized interest paid.

Capitalized interest is expected to be approximately $25 million for the full year 2025.

The effective tax rate for 2025, excluding Cobre Panamá and interest expense, is expected to be approximately 30%.

The full year 2025 depreciation expense excluding Cobre Panamá is expected to be between $700 million and $750 million. While under P&SM, depreciation at Cobre Panamá is expected to be $80 million to $85 million on an annualized basis, which includes approximately $40 million of depreciation associated with the concentrate shed sale.