Glencore’s copper production was 1.2 mt, 5% lower than 2020

Starting the year below $8,000/t, copper prices set a record high of $10,748/t in May, basis improved physical demand conditions, continued financial stimulus and high speculative positioning. Global copper demand remained strong during H2, particularly in North America and Europe where consumption had recovered to pre-Covid levels.

Mine supply growth in 2021, however, was nominal, given the challenges faced in returning to pre-Covid operating rates. Against this backdrop, refined copper inventories reached multi-year lows in H2 2021, with exchange inventories drawing to their lowest levels since 2008.

Cathode premiums moved to their highest levels in five years, while LME cash copper traded at a premium to the three-month price, with a difference of over $1,000/t in October. During 2021, net imports of refined copper to the USA were at levels not seen in more than 10 years.

Spot smelter treatment and refining charges, the fee paid by mines to smelters, reached multi-year lows in 2021, as competition for available concentrates increased. The 2022 benchmark level, however, increased year-over-year, following six years of steady declines, reflecting the market’s anticipation of concentrate mine supply growth.

Looking forward, Glencore expects mine supply growth to be constrained by ageing assets, declining ore grades, a diminished project pipeline and the measures taken to contain the spread of Covid-19, with various new projects likely to experience delays. In the near term, Glencore expects global demand to remain strong, with steady growth rates longer term, driven by population growth and rising living standards in emerging economies.

Climate change policies will also be a key driver for copper growth sectors, given its crucial role in accelerating the clean energy transition, from renewable power generation and distribution, to energy storage and electric vehicles (EVs).

COPPER OPERATING HIGHLIGHTS

Own sourced copper production of 1,195,700 tonnes was 62,400 tonnes (5%) lower than 2020, mainly due to the Mopani disposal (23,800 tonnes), expected lower copper grades at Antapaccay (14,800 tonnes) and lower copper by-products from our mature zinc and nickel mines (26,600 tonnes).

Own sourced cobalt production of 31,300 tonnes was 3,900 tonnes (14%) higher than2020 due to the limited restart of production at Mutanda in 2021.

African Copper

Own sourced copper production of 277,200 tonnes was 23,800 tonnes (8%) lower than 2020, mainly reflecting the disposal of Mopani. The contribution from Mutanda’s limited restart was largely offset by the impact of intermittent power outages at Katanga.

Own sourced cobalt production of 27,700 tonnes was 3,800 tonnes (16%) higher than 2020, reflecting Mutanda’s restart.

Collahuasi

Attributable copper production of 277,200 tonnes was in line with 2020.

Antamina

Attributable copper production of 150,000 tonnes and zinc production of 153,700 tonnes was respectively 22,300 tonnes (17%) and 11,300 tonnes (8%) higher than 2020 reflecting Covid-relating mining suspensions in the base period.

Other South America

Own sourced copper production of 235,200 tonnes was 24,600 tonnes (9%) lower than 2020, reflecting expected lower copper grades at Antapaccay and temporarily reduced production at Lomas Bayas due to short-term leach pad issues, now rectified.

Australia

Own sourced copper production of 85,300 tonnes was 10,100 tonnes (11%) lower than 2020 due to expected changes in mine sequencing at Ernest Henry and additional mine development at Cobar.

Custom metallurgical assets

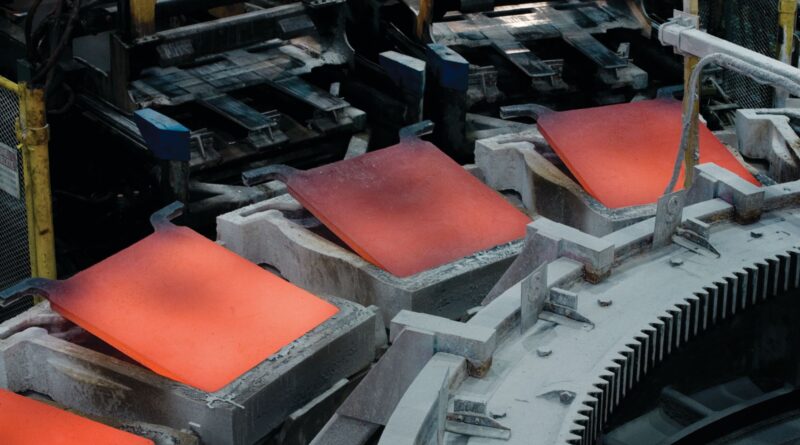

Copper cathode production of 490,600 tonnes was in line with 2020. Copper anode production of 454,000 tonnes was 36,100 tonnes (7%) lower than 2020, mainly reflecting scheduled maintenance at Altonorte in July 2021.