Andean PM: Stockpiled 11,930 tonnes of tin, 16.2M ounces of silver

Andean Precious Metals, a major silver producer, has announced an updated Mineral Resource Estimate (MRE) for its San Bartolomé mine in Bolivia. The new MRE includes tin for the first time, as well as additional silver mineralisation.

Andean announced its San Bartolomé expansion study in December 2021, a three-part exercise which includes the newly released updated MRE, a Scoping Study, and a Tailings Evaluation.

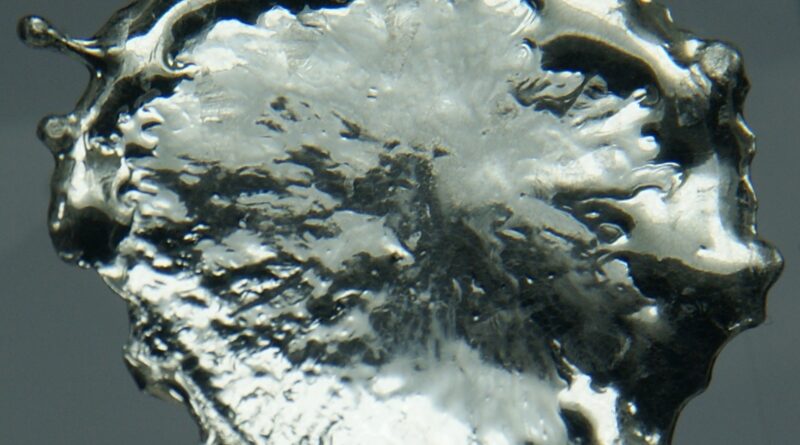

In the new MRE, Andean has re-evaluated existing “pallacos” oxide mineralisation at San Bartolomé for its silver content, as well as its Fines Disposal Facility (FDF). This FDF contains untreated material that was screened out during processing since operations began in 2008. This material contains both silver and tin.

Material added to the FDF was previously assayed before stockpiling. Based on this data, Andean previously estimated that the FDF may contain some 10,000 tonnes of tin. However, the final MRE – produced by SRK Consulting – estimates that the stockpile contains some 11,930 tonnes of the white metal, along with 16.2 million ounces of silver.

While the mineralised material is relatively low grade (averaging 0.114% tin between the Indicated and Inferred Resources), Andean metallurgists believe it could be amenable to significant upgrading through the removal of clays and other fine materials. Detailed metallurgical test work is ongoing.

The second part of the San Bartolomé expansion study – a scoping study – is set to be released in Q2 2022. The work has been delayed by laboratory backlogs caused by the COVID-19 pandemic. This work includes the ongoing mining study, which is focusing on low-cost hydraulic mining methods to recover the FDF material.

Simon Griffiths, President and CEO of Andean Precious Metals, explained that “while silver production remains our primary focus, the incorporation of tin as a co-product has the potential to further strengthen our cashflow profile and drive our all-in sustaining costs significantly lower.”

Using hydraulic mining methods, Andean’s San Bartolomé is likely to become an extremely low-cost producer, meaning that the majority of the tin mineralisation is likely to be upgraded to Reserves. Publication of an official Mineral Reserve Estimate is expected in the final quarter of 2022.