ARM Platinum mines down due to negative mark-to- market adjustments

ARM Platinum headline earnings decreased by 34% to R3 066 million (F2021: R4 666 million). Modikwa Mine reported a 17% decline in headline earnings to R1 270 million (F2021: R1 529 million), which included negative mark-to- market adjustments of R231 million (F2021: R299 million positive mark-to-market adjustments).

The mine increased production volumes by 17% and achieved a below-inflation increase in production unit costs (on a rand per 6E PGM ounce basis) of 2%.

Two Rivers Mine headline earnings reduced to R1 968 million (F2021: R2 972 million), mainly due to negative mark-to-market adjustments of R709 million (F2021: R795 million positive mark-to-market adjustments) and a 12% increase in production unit costs (on a rand per 6E PGM ounce basis). Challenges with grade persisted at the mine as the head grade reduced to 3.20g/t compared to 3.43g/t last year.

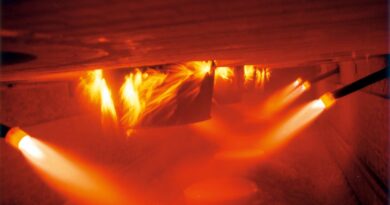

Nkomati Mine reported a headline loss of R172 million (F2021: R165 million headline earnings). The mine was placed on care and maintenance on 15 March 2021. ARM and its joint-venture partner are considering various options for the future of Nkomati Mine.