Alphamin Resources to construct its Fine Tin Project

Alphamin Resources Corp. has reported on its financial results for the quarter ended June 2020. These are financial and operational highlights:

– Tin production up 29% to 2,739 tons versus previous quarter

– AISC per ton of tin sold down 13% to US$10,849 versus previous quarter

– EBITDA of US$12,9 million

– Q3 2020 production guidance of 2,600 – 2,800 tons contained tin

– Increase in ownership of the Bisie tin mine from 80.75% to 84.14%

– $31.2m debt reduction concluded concurrently with $31m offering of shares

– Significant improvement in debt terms following the restructure including an interest rate reduction and partial debt holiday in 2020

– Initiation of significant growth initiatives post quarter-end

OPERATIONS

Tin production from its Bisie mine in the DRC increased 29% to a quarterly record 2,739 tons and was higher than our previous market guidance due to better than expected tin feed grades. Plant throughput increased 8% to 91,928 tons from higher underground volumes derived from the new Open Stoping with Hydraulic Backfill (LHS) mining method.

During the quarter, mined volumes exceeded plant throughput by some 4,000 tons increasing the run-of-mine stockpiles. The processing plant is performing well and various initiatives aimed at achieving consistently higher throughput are underway.

The Bisie project is 84.55% owned by Alphamin Resources through its subsidiary ABM, while the DRC Government owns 5% and the Industrial Development Corporation of South Africa (IDC) owns the remaining 10.45%.

The all-in sustaining cost per ton of payable tin sold reduced by 13% to US$10,849 mainly attributable to increased tin production. Additionally, the previous quarter’s costs were negatively affected by high arsenic penalties and exceptional logistical costs incurred while the national road bridge was under repair.

The Bisie tin mine recorded two lost-time injuries during the past quarter. An employee and a contractor sustained minor injuries during two separate accidents – and both have returned to work.

Production Guidance for the next Quarter

We expect contained tin production of between 2,600 and 2,8002 tons for the quarter ending September 2020. The tin price has recently increased to around US$18,000/t compared to a price realized of US$15,359/t during this past quarter which, if maintained, bodes well for the next quarter’s EBITDA and cash flow generation.

As part of the Company’s two-year strategy to produce over 12,000 tons of contained tin per year and proving additional resource and life-of-mine extensions, the following initiatives were initiated post quarter end:

1. FINE TIN RECOVERY PROJECT

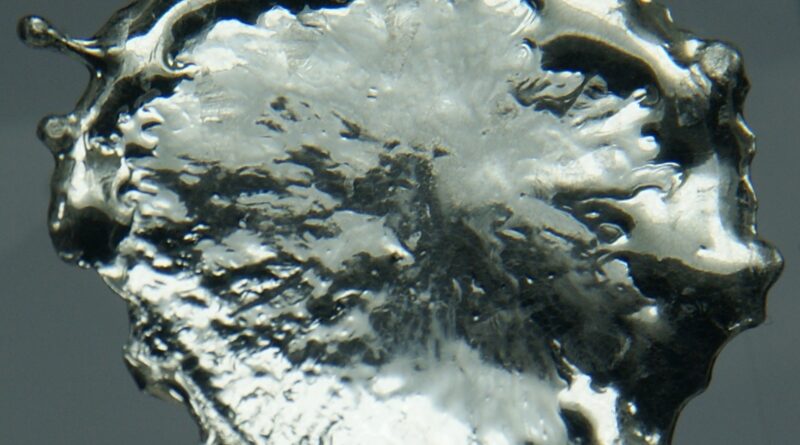

Alphamin has appointed Obsideo (Pty) Ltd as its engineering, procurement and construction management (EPCM) contractor for the execution of its Fine Tin Project (FTP). The FTP is focussed on treating the tailings stream from its gravity concentration plant at Bisie to recover the fine to ultra-fine tin particles.

“When we first commissioned the gravity concentration plant at Bisie, we were focussed on ramping up to a production level of 10,000 tonnes of payable tin per annum, which we have surpassed since Q2 2020 at an annualised ~11,000 tonnes. We believe we can increase plant throughput by another 10% through minor plant de-bottlenecking activities – this could increase annual tin production to ~12,000 tonnes. Additionally, in our efforts to maximise metallurgical recoveries, we have identified process flow streams that contain fine, recoverable tin, and have selected proven metallurgical technology to recover the fine tin from these streams, which should increase tin output further at very low incremental operating costs” said Maritz Smith, CEO of Alphamin.

The FTP will utilise Multi Gravity Separators (MGS), set-up in rougher-cleaner configuration, to treat a 20 ton per hour process flow stream from the current plant’s tailings running at a grade of 0.8-1.1% tin. The FTP is estimated to produce a concentrate containing 45-55% tin which will be blended with the concentrates from the main gravity concentration plant to produce a final concentrate estimated to contain 60% tin.

“The MGS technology was selected for the FTP as a result of its proven track record in the tin industry to recover particles down to 10um in size, low energy requirements and the high upgrade ratios achievable. Internal analysis shows the FTP has the potential to increase production at Bisie by 400 – 800 tonnes of payable tin per annum. By increasing units of production at a very low incremental cost, the FTP is expected to further decrease our all-in sustaining costs (AISC), securing our place as a lower quartile cost producer.” said Smith.

The projected timeline for the FTP execution from approval to achieving nameplate capacity is 11-months. Orders for the long lead items have already been placed and the total project expenditure is estimated at US$4,6 million.

2. MPAMA SOUTH DRILLING PROGRAM

Alphamin has appointed T3 Drilling SARL, an internationally recognised drilling contractor, to undertake a 6,000 metre diamond core drilling program at its Mpama South prospect, expected to commence in Q3 2020. Mpama South is located approximately one kilometre south of the main processing plant at Bisie and the drilling program has been designed to delineate a maiden Mineral Resource at Mpama South.

“We are encouraged by the historical drilling results from Mpama South and we are optimistic that by applying our exploration experience as demonstrated at Mpama North, that this drilling program will deliver sufficient information to support the declaration of our maiden Mineral Resource at Mpama South and allow for possible extension to the life of operations at Bisie,” commented Smith.

“While Mpama South is the first drill target post-successful commissioning of the Mpama North operations, we have already identified a number of areas along the Bisie Ridge showing soil geochemistry anomalies similar to those found at Mpama North. We expect to generate a further 3-5 drill targets from these anomalies over the next 18-months.

“Additionally, plans are being developed for deep level drilling at our producing Mpama North orebody which is currently open at depth.”