AmPlats expects PGM production within guidance in 2022, lowers forecast for 2023, 2024

Johannesburg

Anglo American Platinum (AAP), a member of the Anglo American plc Group, has reported that its PGM metal-in-concentrate and refined production for 2022 expected to be within guidance.

“Despite navigating through several headwinds, we maintained a stable operating environment and expect to close the financial year within guidance, with metal-in-concentrate of around 4.0 million ounces and refined production of around 3.8 million ounces,” said CEO Natascha Viljoen.

She added that the company continues to experience high levels of inflationary cost pressures, leading to a unit cost of around R15,300 per PGM ounce (previous guidance: R14,000 – R15,000 per ounce) and will continue with its strong focus on cost mitigation and containment in 2023.

The company also revised its medium-term outlook to reflect its revised operational environment.

In 2023, AAP expects to produce 3.6 – 4.0 Moz metal-in-concentrate PGM (previous guidance: 4.1 – 4.5 Moz) and 3.6 – 4.0 refined PGM (previous guidance: 3.8 – 4.2 Moz). In 2024, AAP anticipates to produce 3.6 – 4.0 Moz metal-in-concentrate PGM (previous guidance: 4.1 – 4.5 Moz) and 3.6 – 4.0 refined PGM (previous guidance: 4.1 – 4.5 Moz).

The company explained that in 2023 and 2024, its metal-in-concentrate production will reduce due to lower grade at Mogalakwena, lower volumes from Amandelbult, as well as lower purchase-of-concentrate volumes than previously anticipated.

Furthermore, AAP said that its unit cost guidance for 2023 will increase to between R16,800 – R17,800 per PGM ounce (2022: ~R15,300 per ounce), or between $990-$1,050 per PGM ounce, as the company expects to see a continuation of high energy, chemical, explosives, diesel, and other imported input costs, as well as lower production.

“We continue to progress the Future of Mogalakwena, with a view that a decision on the third concentrator will be made within 18-24 months to ensure capital efficiency, improve technology deployment, and mitigate supply chain and inflationary pressures to enable the successful execution of a highly value accretive project,” CEO Natascha Viljoen added.

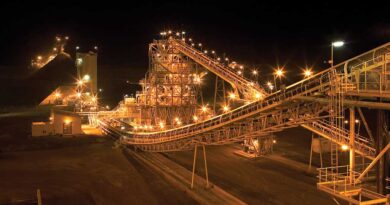

Anglo American Platinum is a member of the Anglo American Group and is a leading primary producer of platinum group metals. Its mining, smelting and refining operations are based in South Africa. Elsewhere in the world, the company owns Unki platinum mine and smelter in Zimbabwe.

Anglo American is a leading global mining company and producer of diamonds (through De Beers), copper, platinum group metals, premium quality iron ore and steelmaking coal, and nickel – with crop nutrients in development.