Anglo Teck to offer more than 70% copper exposure

Anglo American and Teck Resources agreed to combine the two companies in a merger to form the Anglo Teck group, a global critical minerals champion and top five global copper producers, with more than 70% exposure to copper. The Merger is expected to close within 12-18 months.

The Anglo Teck group will have its global headquarters in Vancouver, British Columbia, Canada, where the CEO, Deputy CEO, and CFO and a significant majority of the senior executive team will be based. Anglo Teck will also retain corporate offices in London and Johannesburg, thereby contributing to and drawing on three key centres of mining finance and technical expertise to support Anglo Teck’s growth and investment ambitions. Anglo Teck plc will inherit Anglo American’s UK incorporation and tax status.

Duncan Wanblad, Chief Executive Officer of Anglo American, commented: “We are unlocking outstanding value both in the near and longer term – forming a global critical minerals champion with the focus, agility, capabilities and culture that have characterised both companies for so long. Having made such significant progress with Anglo American’s portfolio transformation, which has already added substantial value for our shareholders over the past year, now is the optimal time to take this next strategic step to accelerate our growth. We have a unique opportunity to bring together two highly regarded mining companies whose portfolios and capabilities are deeply complementary, while also sharing a common set of values. We are all committed to preserving and building on the proud heritage of both companies, both in Canada, as Anglo Teck’s natural headquarters, and in South Africa where our commitment to investment and national priorities endure. Together, we are propelling Anglo Teck to the forefront of our industry in terms of value accretive growth in responsibly produced critical minerals.”

Jonathan Price, Chief Executive Officer of Teck, commented: “This merger of two highly complementary portfolios will create a leading global critical minerals champion headquartered in Canada – a top five global copper producer7 with exceptional mining and processing assets located across Canada, the United States, Latin America, and Southern Africa. It is a natural progression of our strategy and portfolio simplification, which created a platform to enable exactly this sort of transformative transaction. Bringing together our world-class copper assets, premium iron ore and zinc operations and an outstanding pipeline of high-quality growth projects provides enormous resiliency and optionality. This transaction will create significant economic opportunity in Canada, while positioning Anglo Teck to deliver sustainable, long-term value for shareholders and all stakeholders.”

Anglo Teck will benefit from a global capital markets footprint across major centres of mining finance and technical expertise, with expected stock market listings on the LSE (Equity Shares (Commercial Companies)) JSE, TSX and NYSE (to be implemented as a listing of American Depositary Receipts), subject to the approval or acceptance of each applicable exchange.

Strategic Rationale and Benefits of the Transaction

Premier critical minerals portfolio with world-class copper assets

- Top five global copper producer with combined annual copper production of ~1.2mt expected to grow by c.10% to ~1.35mt in 2027 from a portfolio of long-life assets with attractive cost profiles and outstanding resource endowments, including8:

- Collahuasi (Chile, 245.8kt attributable production, 44% ownership)

- Quebrada Blanca (Chile, 207.8kt production, 60% ownership)

- Quellaveco (Peru, 306.3kt production, 60% ownership)

- Los Bronces (Chile, 172.4kt production, 50.1% ownership)

- Highland Valley Copper (Canada, 102.4kt production, 100% ownership)

- Antamina (Peru, 96.1kt attributable production, 22.5% ownership)

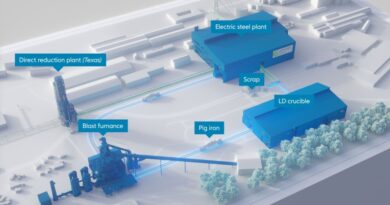

- A major producer of premium iron ore (61mt)9 that facilitates cleaner steelmaking from mines in South Africa and Brazil

- One of the world’s largest producers of mined zinc through the world-class Red Dog mine in Alaska, as well as operator of one of the world’s largest fully integrated zinc and lead smelting and refining facilities at Trail Operations in British Columbia

- Anglo Teck will remain committed to Anglo American’s announced portfolio simplification, including ongoing work to separate De Beers for value alongside completion of the steelmaking coal and nickel disposals. Anglo American will continue to advance these efforts prior to completion

Compelling value creation through synergies

- Total anticipated pre-tax recurring annual synergies of US$800 million and an additional US$1.4 billion (100% basis) of underlying EBITDA revenue synergies between the adjacent Collahuasi and Quebrada Blanca operations on an average pre-tax annual basis from 2030-2049, which is expected to result in an increase of c.175,000 tonnes of potential additional annual copper production

- Anglo American and Teck have both recently been engaged in substantial portfolio simplification, which makes this the right time to bring the two companies together with a streamlined, new organisational structure that retains and leverages the best of both organisations across a larger global business

Additional value-creation opportunities

Copper

- Collahuasi and Quebrada Blanca are adjacent operations that have the potential to unlock value in a capital efficient manner. Near-term opportunities to enhance cash flow and value include using Quebrada Blanca’s infrastructure to process higher-grade ore from Collahuasi. Anglo American and Teck are committed to working at pace with the other stakeholders of these assets to realise US$1.4 billion (100% basis) of underlying EBITDA2 revenue synergies between the adjacent Collahuasi and Quebrada Blanca operations on an average annual basis from 2030-20493 primarily through operational integration and optimisation of Collahuasi and Quebrada Blanca

- Combined proven project development capabilities to maximise the potential from an extensive pipeline of brownfield and greenfield copper growth options in Canada, Chile, Peru, Mexico, the United States and Finland, with a pathway towards a significant additional uplift in copper production

- Anglo Teck will remain committed to working with Codelco to implement a joint mine plan in respect of the two companies’ respective, adjacent copper mines of Los Bronces and Andina in Chile with the view to unlocking an additional 2.7 million tonnes of copper production during the course of that joint mine plan after 2030

- Other development prospects include:

- the Galore Creek and Schaft Creek projects in Northwestern British Columbia, Canada

- Zafranal in Peru, San Nicolas in Mexico, NuevaUnión in Chile, NewRange in the US and Sakatti in Finland

- further brownfield opportunities to deliver the full potential from outstanding resource endowments across the existing portfolio

- Anglo Teck will continue to build on both Anglo American and Teck’s longstanding success in and commitment to global mineral exploration and discovery, supported by a focus on technology and innovation.

Premium iron ore, crop nutrients and germanium

- Anglo Teck is also set for significant growth in premium iron ore output through the development of the high-quality, multi-billion tonne Serpentina resource in Brazil, an adjacency to Minas-Rio, and the addition of UHDMS technology at Kumba in South Africa to deliver a far greater proportion of premium quality iron ore products and thereby enhance margins

- Opportunity to significantly increase germanium and other specialty critical minerals production from Trail Operations metallurgical facility, supporting the critical minerals priorities of Canada

- Anglo Teck will continue to progress the development of the Woodsmith project in the UK with its ongoing potential to be a generational asset in crop nutrients. Full development remains subject to meeting stringent investment criteria for risk-adjusted value, including syndication to one or more investment / strategic partners

Exploration and discovery

- Anglo Teck will continue to build on both companies’ longstanding success in and commitment to mineral exploration and discovery, with exploration teams active across Canada, Latin America, the US, Europe, Southern Africa and Australia

- Anglo Teck plans to invest at least CAD$300 million (over five years following completion) in critical mineral exploration and technology in Canada, recognising Canada’s extensive potential for further responsible mineral development

- Anglo Teck will continue to support and partner with the Canadian junior mining sector, an important part of Canada’s mining ecosystem, by investigating the application of a range of modern geoscience and data approaches in mineral exploration opportunities, including AI, and supporting broader partnerships across Anglo Teck’s operating footprint, particularly in South Africa and southern Africa. As part of the effort to support the junior mining sector, Anglo Teck also plans to make financial contributions to South Africa’s Junior Mining Exploration Fund in partnership with the Industrial Development Corporation of South Africa and the South African Department of Mineral and Petroleum Resources, which seeks to assist qualifying junior miners to conduct prospecting work