Green hydrogen to decarbonise the steel industry

The steel industry is responsible for around 5 per cent of CO₂ emissions in the European Union (EU) and 7 per cent globally. The sector is a major part of the EU economy, and here it has ambitious plans to decarbonise, aiming to cut emissions by 80-95 per cent by 2050, compared to 1990 levels.

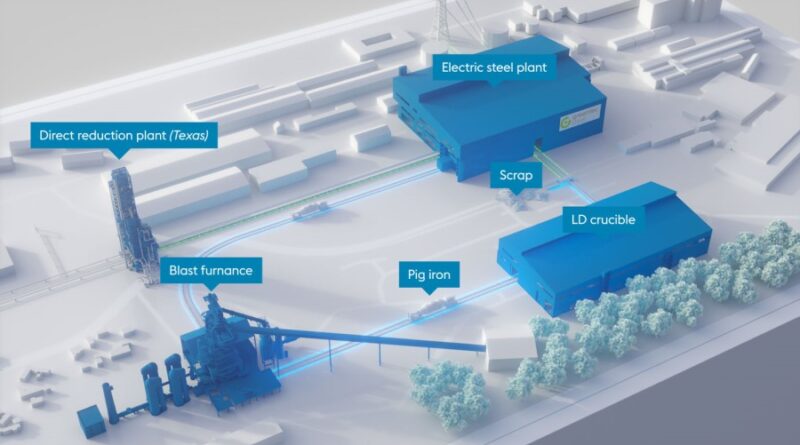

Published last year, a report by the European Commission Joint Research Centre highlights that the EU steel industry is increasingly focusing on hydrogen-based steelmaking to achieve its goals. Several projects announced across Europe aim to replace existing steel production processes with new steel plants based on the direct reduction of iron ore using hydrogen. This also dovetails with the EU’s energy independence aims – its REPowerEU plan highlights that around 30 per cent of primary steel production in the EU is expected to be decarbonised by 2030 using renewable hydrogen.

The direct reduction of iron ore to iron using hydrogen instead of natural gas or coal has the potential to completely avoid the use of fossil fuels in the steel making process if the hydrogen used is green hydrogen, produced by electrolysis. Platinum is key to proton exchange membrane (PEM) electrolysers which, when powered with renewable energy, generate green hydrogen.

For example, the global steel and technology group, voestalpine AG, is pioneering an EU-funded project ‘H2FUTURE’, utilising PEM electrolysis to generate green hydrogen for its steel-making plant in Linz, Austria.

Green hydrogen confidence

Hydrogen is already widely used in many other industrial processes, including ammonia and petrochemical production, with current demand exceeding 80 million tonnes per annum and poised to grow by 9 per cent per annum between now and 2030. This demand is, by and large, currently met through the steam methane reformation of natural gas, a process that releases between nine and ten kilograms of CO2 for every kilogram of hydrogen produced.

The existing market for hydrogen is already over 80 Mtpa and is expected to grow at 9 per cent per annum through to 2030. Source: IEA, WPIC Research

Green hydrogen has the potential to decrease this environmental impact by up to 95 per cent, and the pre-existence of a robust and growing hydrogen market adds further momentum to the development of green hydrogen projects, giving investors the confidence to proceed. Indeed, installed production capacity for green hydrogen is doubling every two years, as are plans for new production capacity. Further, government subsidies for low-carbon hydrogen projects between 2022 and 2030 now total US$146 billion. The World Platinum Investment Council estimates that, if all planned green hydrogen projects are developed with PEM electrolysers, the cumulative platinum demand to 2030 would be in excess of 2.7 million ounces.