Antofagasta: Strong performance in challenging environment

Antofagasta plc, a copper mining group based in Chile, has reported that its copper production in the first six months of the year was 371,700 tonnes, in line with expectations and 4.0% lower than in the same period last year on lower grades, particularly at Centinela Concentrates.

Cash costs before by-product credits for the first half of the year were $1.51/lb, a 9.0% improvement on the same period last year primarily due to the weaker Chilean peso, lower input prices and tighter cost control

Net cash costs were $1.12/lb for the first half of the year, a 5.9% improvement on the first half of 2019. This was primarily due to lower cash costs before by-product credits, partially offset by lower by-product credits

Revenue for the first half of 2020 was $2,139 million, 15.3% lower than the same period in 2019 mainly as a result of lower realised copper prices and sales volumes, partially offset by the increase in the realised gold price.

EBITDA was $1,013 million, $293 million lower than in the same period last year on lower revenue partially offset by lower operating costs due to the weaker Chilean peso, lower input costs and continued tight cost control.

Net debt decreased by $244 million to $320 million during the period following the refinancing of Antucoya.

Capital expenditure of $549 million was 42% of full year guidance, and while growth projects have been temporarily suspended since March, engineering and procurement work has continued.

“Following the outbreak of COVID-19 and its impact on consumer markets, the realised copper price was 12.5% lower compared with the same period last year and this impacted our revenue. However, despite these challenges the Group had a strong operating and cost performance with copper production of 371,700 tonnes, sales volumes falling by only 2% compared to the first half of 2019, and a 6% improvement in net cash costs, aided by savings of $78 million from our Cost and Competitiveness Programme,” Antofagasta CEO Iván Arriagada said.

“Work on our growth projects is now accelerating and we are maintaining our full year guidance at the lower end of the original 725-755,000 tonnes range, at a net cash cost of $1.20/lb.”

Capital expenditure for the year is expected to be less than $1.3 billion, assuming the work on the Los Pelambres Expansion and Zaldívar Chloride Leach projects ramps-up in the second half of the year.

The construction work on the Los Pelambres Expansion project has been temporarily suspended since March with some limited work continuing, mostly on the desalination plant at Los Vilos. The project is now restarting in stages during H2 2020, integrating new COVID-19 health protocols.

At the time of the restart of construction in August, the suspension of activities to date has already delayed the original project schedule by six months at an additional cost of approximately $50 million.

At Zaldívar construction of the Chloride Leach project had just commenced at the time of the COVID-19 outbreak and as a result further mobilisation to site was suspended in March. Activities are now resuming largely as per the original schedule but delayed by approximately six months to the first half of 2022 due to the suspension and integration of fully revised health protocols. The impact of the suspension of activities is expected to be absorbed within the original estimated project cost of $190 million.

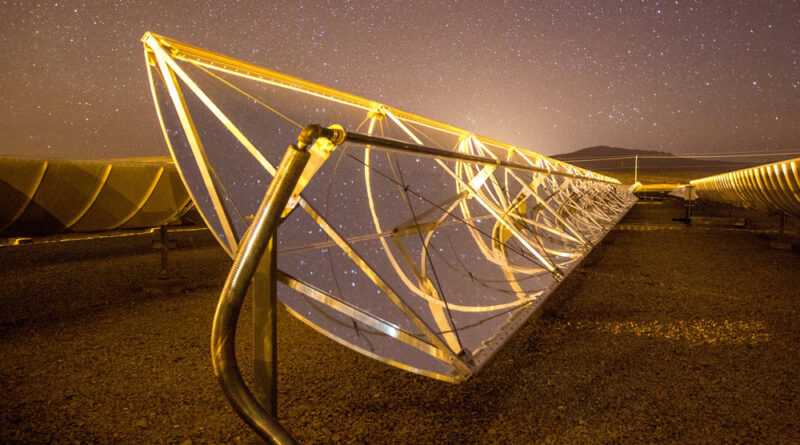

Centinela signed a 100% renewable energy contract which will be effective from 2022 until 2033. This new contract will be value accretive as power costs will be significantly reduced in stages from 2020 onwards. From 2022 all the Group’s mines will use only renewable energy, with Zaldívar being the first to go 100% renewable on 1 July 2020.

The Company has been an active participant in the International Council on Mining and Metals’ (ICMM) working group on the Global Industry Standard on Tailings Management that was released earlier this month. The new standard is an important step in strengthening current practices in the industry for the management of tailings facilities from site selection to after a facility is closed.