Changing face of nickel consuming industry

Whilst the stainless steel industry today still accounts for around 70% of total nickel consumed, growth has been driven by Class II (nickel pig iron and FeNi) nickel product use, with Class I (metal, chemicals) nickel product use growing but by a smaller total volume.

The dominant driver of nickel demand growth in the future is forecast to change, and so too the nickel product mix. Such change is forecast to come in the form of lithium-ion (Li-ion) batteries, which have become the technology of choice for core automotive and energy storage system (ESS) applications.

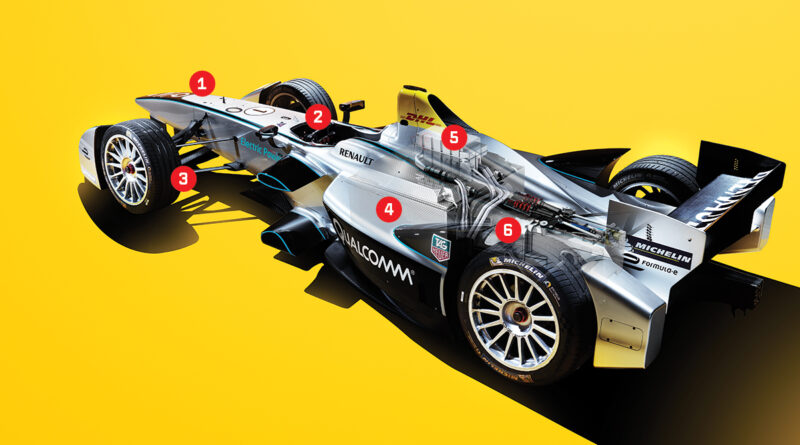

The importance of nickel within Li-ion batteries cannot be understated, as cells are now being manufactured with higher ratios of this transition metal. Nickel-rich Li-ion batteries show a superior energy density to other types, and lower metal cost to higher cobalt containing technology, making them the technology of choice for use in plug-in EVs.

The Li-ion battery’s rise to prominence began in the form of lithium-cobalt-oxide (LCO) in the early 1990s, since becoming the staple technology used in portable electronic devices. For contemporary automotive applications, however, nickel-cobalt-manganese (NCM) or nickel-cobalt-aluminium (NCA) cathode chemistries are used, although other lower-performance technologies also compete.

It is forecast that these will continue to be the main chemistries used in Li-ion battery for high performance, long-range EVs as original equipment manufacturers (OEMs) continue to invest in and transition production lines toward mass-scale plug-in EV manufacturing.

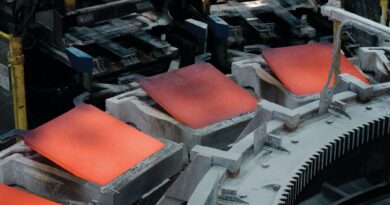

Such a transition in core growth end-use nickel demand sectors does not come without challenges. Not all nickel is classified as suitable for use in Li-ion batteries, where nickel itself must be in a chemical compound form (nickel sulphate hexahydrate: NiSO4.6H2O) for use in cathode precursor manufacturing.

Roskill’s forecast indicates that nickel demand from batteries could reach 36% of total nickel demand by 2030, increasing from 6% in 2020. This growth trajectory represents the main challenge faced by the nickel market.