China, the CIS and Japan produce most titanium sponge

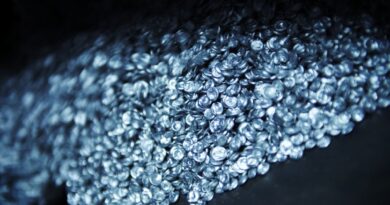

Sponge production, used to produce ingots for aerospace-grade titanium, is limited to a handful of countries, due to the capital-intensive and energy-intensive nature of the Kroll Process and the need for handling hazardous chemicals.

70-80% of the world’s sponge is produced by China and the CIS, with Japan making up most of the rest. As of May 2025, the US had only one titanium sponge producer in Utah with a capacity of 500 tons per year; in 2023, the US imported 42,000 tonnes of titanium sponge. This means the US and many allies rely entirely on imports, primarily from Japan’s producers (Toho Titanium and Osaka Titanium) and Kazakhstan’s UKTMP, as Russian sponge is now largely off-limits due to sanctions.

This concentration of sponge supply is a strategic vulnerability to any disruption (whether incidental or accidental). The US Department of War has identified titanium sponge as a “potential single point of failure” in the defense supply chain as far back as 2018.

Building a new sponge plant or expanding an existing one takes years and hundreds of millions of dollars, with many companies hesitant and limited by resources to even expand capacity.

As stated, in aerospace and defense, only high-quality materials from qualified sources can be used as impurity levels and consistency are critical — this is the case for titanium sponge, and most of titanium sponge exports from China are not certified for Western aerospace, a deliberate barrier (for quality and security reasons). This certification bottleneck means even if China has sponge to spare, Western aerospace manufacturers can’t easily use it unless it meets stringent standards and ITAR-like restrictions can be navigated. Thus, sponge remains a choke point for the West – ample globally, but not all of it accessible.