China to continue its reign on the cobalt supply downstream sector

China is the world’s largest producer of refined cobalt, most of which is produced from cobalt intermediates imported from the DRC, and the country will continue to hold its reign on the downstream sector of the cobalt supply chain in the coming decades.

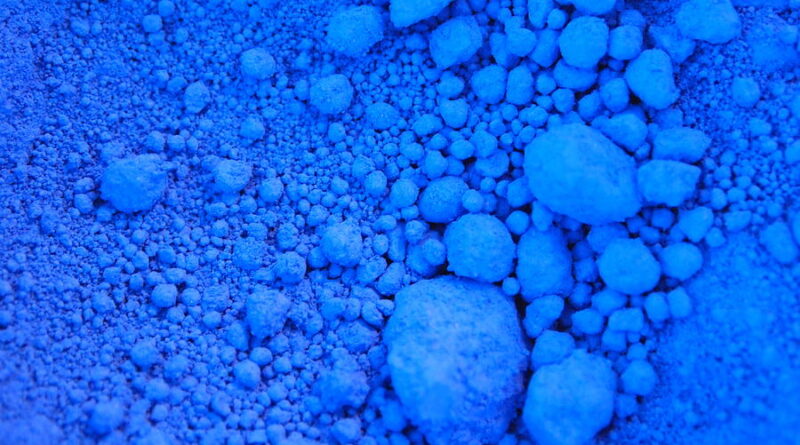

In 2020 China produced 67% of the world’s refined cobalt, totalling 89.2kt, and within refined cobalt more than 80% of the world’s cobalt sulfate. While all refined forms are produced in China, cobalt sulfate and tetroxide, used in lithium-ion batteries, dominate market share.

Fitch expects Chinese refined cobalt production to increase, although the country’s market share will likely reduce in the coming years with global refinery projects coming online in the next few years. Jinchuan Group is the main cobalt producer in China with its integrated facilities.

China has limited presence in the upstream sector of the global cobalt supply chain. In 2020, the country only accounted for 1.6% of global cobalt concentrate production, coming in at eighth position with 2.3kt.

China holds just 1.1% of global cobalt resources, and we do not expect the country to play a significant role in the upstream sector of the global cobalt supply chain in the foreseeable future.

While low domestic resources is a major impediment for China’s cobalt security, the government encourages foreign ownership of cobalt mines and strategic partnerships. For instance, China Molybdenum‘s acquisition of Freeport-McMoran‘s stake in the Tenke Fungureme Mine in the DRC in December 2020 is a major move towards this aim.

Outside China, Japan is the only other cobalt refiner in Asia, although the country only produces cobalt metal in the form of cathodes. Sumitomo‘s Niihama refinery in Japan is the main producer, with an annual production of approximately 4kt of refined cobalt metal.