Chinese refractory grade bauxite and magnesite in short supply

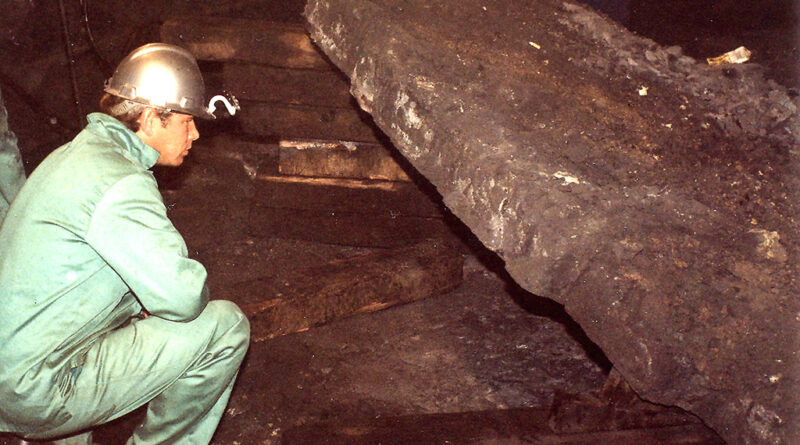

Since 2017, non-metallurgical bauxite supply has significantly changed in China due to environmental protection regulations and activities which will continue in the coming years.

Chinese experts expect regular bauxite production restriction and mine restrictions to continue with production costs increasing and profits will be further suppressed. Shortage of high grades of calcined bauxite will also be ongoing; ore supply cannot be solved in at least the coming 2-3 years, as sustainable supply becomes more and more important.

Regarding magnesia, China expects 2021 to be “a hard year full of uncertainties”.

Chief among the influences on Chinese magnesia will be Liaoning Government’s Action Plan: resource integration, establishment of two or three magnesite mining groups by 2030, and overall to strengthen the bargaining power of magnesia participants.

Wong described the plan as “Challengeable tasks with huge difficulties to push forward because it involves too many interests on different sides.”

Meanwhile, already in January 2021, the Liaoning Government had released the news of Baowu Steel to merge Haicheng Magnesite Corp.