Cobalt mine and refining supplies concentrated in the DRC and China

The global cobalt supply chain is set to remain highly geographically concentrated in the coming years – in the DRC for mine production and China for refining – which will likely pose procurement challenges for battery manufacturers.

However, there is currently a solid global project pipeline, due to the rise in cobalt prices and the expected demand boom amidst the proliferation of battery manufacturing projects, which will aim to diversify to some extent production channels.

Australia holds significant growth potential in the cobalt producing landscape with multiple integrated cobalt projects in the pipeline. Experts see limited production growth in Europe and North America in the coming years due to the lack of resources and projects.

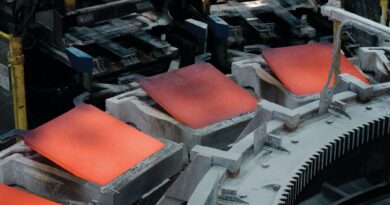

The battery revolution will increasingly dictate cobalt production trends, with most of global refined cobalt being converted to chemical forms that are used in rechargeable batteries as opposed to cobalt metal that is mainly used in other industries.

While new cobalt projects are expected to come online the next decade, the Mineral Processing and Metallurgy highlights that risks to the completion of these projects are abound. Many are still in the pre-feasibility stage, especially in Australia, and may not reach fruition in the end due to lack of finance or environmental opposition for instance.

Global cobalt projects are also likely to face environmental scrutiny, whereas the possibility of batteries without cobalt might dampen the metal’s demand outlook and prices altogether.