Commodity markets show slow recovery, gold up and steelmaking favours iron ore

According to commodity market analyst CRU, all optimism for commodity markets at the start of the year was quickly extinguished as the coronavirus emerged in Wuhan, China.

Prices have been dragged down further by dire market fundamentals which were a result of government-imposed lockdowns in the major global economies. Both supply and demand have been lowered across the board, but demand has been harder hit and will be slower to make a recovery. Most commodities have further to fall from here. There has been a profound human cost to the pandemic and the economic fallout of governments’ responses is just starting to be counted.

China’s first-ever quarterly GDP contraction

China’s published a GDP growth rate of -6.8% y/y in Q1 2020 and -9.8% q/q. This is the first negative growth figure since the start of the economic reforms initiated by Deng Xiaoping in 1978. This number is not surprising given the lockdown brought the economy near to a standstill for almost two months. China’s growth rate bears particular significance for commodity markets as its economy has come to account for roughly half of global commodity consumption and production. Furthermore, with many economies around the world still in lockdown, we are looking to China to gauge the economic cost of the Covid-19 containment. The economic repercussions will be significant.

Months of lockdown lower global GDP

At the beginning of May, many economies were starting to lift lockdowns or at least discuss exit strategies, with the caveat that we are entering a ‘new normal’. CRU is assessing the full economic impact of bringing swaths of the global economy to a standstill. Using estimates of the loss of output by sector, one month of the lockdown lowers the level of annual GDP by 2–3%. CRU is now forecasting a global recession in 2020, with growth in the Eurozone and USA turning negative, and China suffering a “hard landing”, with China’s economic growth slowing to just 1.6%.

Prices driven to new lows as market fundamentals take hold

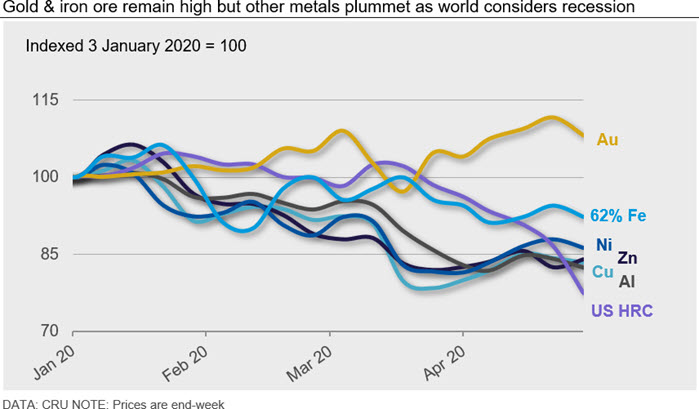

Optimism for commodity prices at the start of the year was quickly extinguished and prices were dragged down as the emergence of coronavirus in Wuhan spread into a global pandemic. In an environment of macroeconomic uncertainty, LME prices have declined, and safe-haven assets such as gold have flourished. The steelmaking value chain continues to favour iron ore miners as prices remain elevated, due largely to supply losses and low shipping costs. The steel industry is experiencing extremely weak downstream demand, resulting in a rapid stock build.