Cornish Metals highlights significant progress in its projects

In its latest quarterly report, Cornish Metals highlighted its robust cash position and significant progress in its projects. The company had net cash of $49,078,875 at the end of the period, a significant increase from $4,286,535 a year earlier. The upsurge was primarily driven by a successful share offering, which also contributed to a reduction in the company’s loss for the period to $206,802, down from a $979,427 loss at the same stage in 2022.

Major developments have been reported in the company’s operations in Cornwall. The drill program at South Crofty, aimed at collecting samples for metallurgical testwork as part of the Feasibility Study, is nearing completion and is projected to conclude by the end of June 2023. Furthermore, construction of the water treatment plant (WTP) is substantially complete, with dewatering expected to commence later in the summer. The construction cost is estimated to be between £6.5 million and £7.0 million.

Looking ahead, Cornish Metals outlined its use of proceeds from the previous share offering to advance the South Crofty tin project. The company plans to complete the dewatering program, conduct a drill program for metallurgical studies, produce an updated Mineral Resource estimate, and complete a Feasibility Study by the end of 2024. Additional exploration programs and evaluation of other potential targets are also being considered.

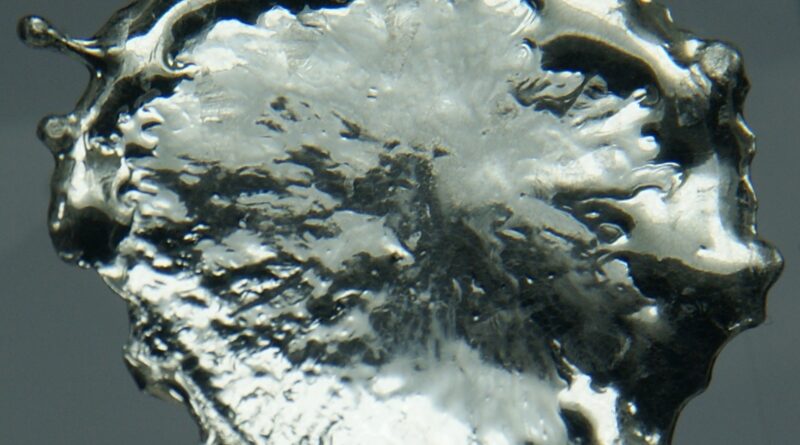

Cornish Metals aims to redevelop the South Crofty tin and United Downs copper/tin projects, which it acquired in July 2016, along with additional mineral rights. These sites have a historical mining presence for various minerals including copper, tin, zinc, and tungsten.