Alphamin achieves record fourth quarter production

MAURITIUS – Alphamin Resources, a producer of 4% of the world’s mined tin from its high grade operation in the Democratic Republic of Congo, has provided the following operational and financial update for the quarter ended December 2020:

- Record EBITDA of $16,7m at a tin price of $18,497/t (Current: ~$24,000/t)

- Record tin production of 2,898 tons, up 13% from the previous quarter

- Abnormal seasonal rains resulted in logistical constraints which negatively impacted Q4 2020 sales volumes (down 14% from the previous quarter)

- Q1 2021 tin sales guidance of 3,200 tons (Q4 2020: 2,306 tons) on improved road conditions

- Commencement of drilling campaign at the adjacent Mpama South deposit

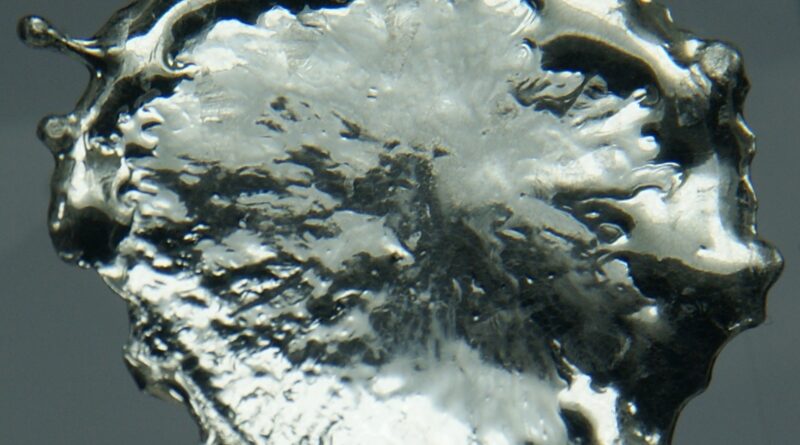

- Fine tin recovery plant construction 80% complete

OPERATIONAL AND FINANCIAL PERFORMANCE

Tin production increased 13% to a quarterly record of 2,898 tons and was higher than our previous market guidance of 2,600 to 2,800 tons. This outperformance was due to better than expected tin feed grades and plant recoveries. The processing plant performed at an average recovery of 74% for the quarter, including a record recovery of 77% achieved in December 2020.

Quarterly sales decreased by 14% due to extreme seasonal rains impacting export road conditions. Weather stations across the export route reported rainfall above 159% of the long-term mean.

EBITDA for Q4 2020 increased to a record $16,7million, albeit negatively impacted by lower tin sales volumes. The short dry-season (Jan-March) allows road maintenance to be done and already road conditions have improved.

Alphamin Resources expects to sell approximately 3,200 tons of contained tin during Q1 2021 thereby recouping most of the past quarter’s sales shortfall.

AISC per ton of tin sold in Q4 2020 increased by 6% to $11,384 from the previous quarter. The increase followed additional outbound road maintenance costs and employee bonus provisions as well as the impact from lower unit production costs resulting in a reduced concentrate stockpile valuation.

The LME tin price has increased from approximately US$18,497/t during Q4 2020 to a current level of ~US$24,000/t, which bodes well for the Company’s 2021 earnings.

Alphamin’s short-term objective is to increase annualised contained tin production from the current level of 11,000t to 13,000t. This increase is expected from July 2021 following the commissioning of the previously announced fine tin recovery plant and a planned increase of 5% in processed ore volumes.

On this basis, Alphamin Resources expects contained tin production of 5,500t in H1 2021 increasing to 6,500t in H2 2021, which would achieve its annualised production goal of 13,000t thereafter.

AISC per ton of tin sold is expected to increase on the back of higher tin prices as royalties and marketing fees escalate. Additionally, sustaining capital expenditure will likely be higher than 2020.