Correction in commodity prices expected, especially iron ore

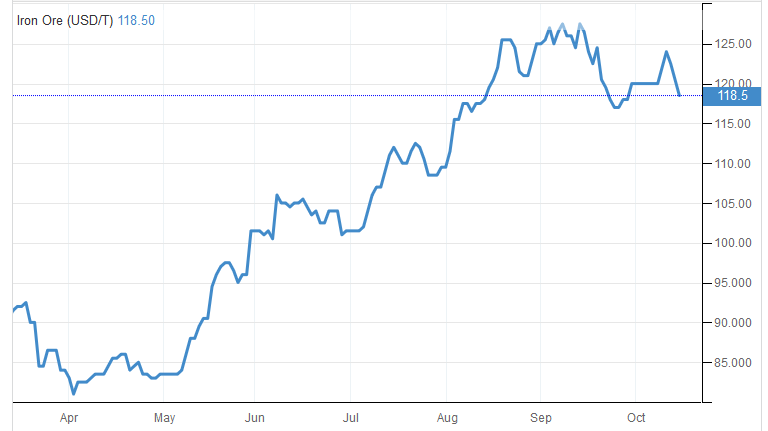

Standard Bank expects to see some moderation in commodity demand when the Chinese local bond issuances come to an end in October, however, the bank believes that the Chinese economy will continue to recover in 4Q20E relative to 2019. As a result, the bank expect some correction in commodity prices especially iron ore however we believe a collapse is unlikely.

“We highlight that commodity restocking prior to the Chinese Lunar New Year tends to start in December which could potentially mitigate demand losses earlier in the quarter,” said Thabang Thlaku, Mining and Commodities Analyst at Standard Bank. “We believe an ex-China economic recovery is starting to emerge, as indicated by the Chinese export orders PMI’s switch from contraction to expansion. This recovery is likely to be slower and less pronounced than China’s and we should see demand for commodities start to improve in 4Q20E and go up materially in the latter parts of 1H21E.”

“We prefer the energy complex and base metals over precious metals and bulks. We have upgraded our medium-term iron ore prices and increased our LT price from US$55/to US$60/t due to shipping and SIB cost increases.”