Diamond deal suggests flaws in De Beers, Botswana relationship

An exceptional diamond agreement between De Beers and one of its sightholders, Diacore, raises questions about the secrecy shaping Botswana’s diamond industry, according to Khadija Sharife and Ntibinyane Ntibinyane, writing for Panama Papers Investigative Centres.

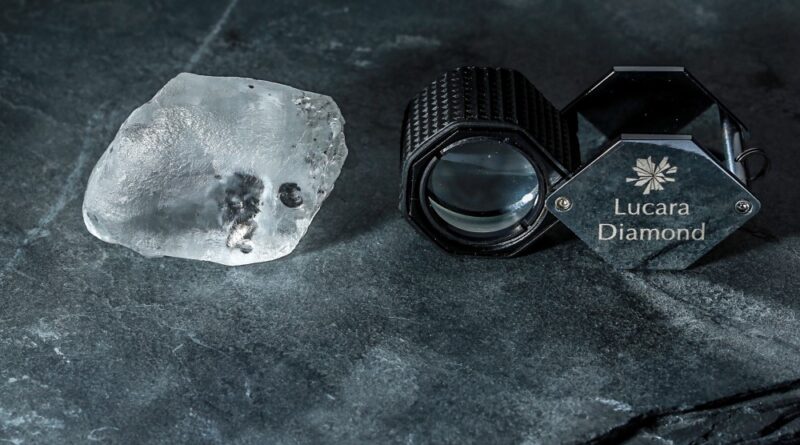

In early 2015, a pilot agreement between Diacore International Limited and De Beers Global Sightholder Sales negotiated the sale of an exceptional diamond worth $19 million. Diacore, arguably De Beers largest sightholder, paid $9.5 million for 50% of the diamond’s value.

Details about the agreement have emerged from leaked internal data from Panama-based law firm Mossack Fonseca, obtained by German newspaper Süddeutsche Zeitung and shared through the International Consortium of Investigative Journalists.

The documents show that the contract was negotiated from Diacore’s British Virgin Islands base. Though Botswana-based diamond mining company Debswana was listed as the gemstone’s physical location, it is not known whether the diamond was mined in Botswana as its origin was not declared.

De Beers recently relocated its international sorting center from London to Gaborone, which has resulted in rough diamonds from outside Botswana being sold within the country. However no register is kept of exceptional diamonds, which limits stakeholders’ ability to identify the volume and value of rough stones sold, or the subsequent sale taxes and royalties that should be paid.

Taxes, royalties and diamond valuation formulas are usually documented in mining agreements rather than in sales agreements. But to add to the complexity in the Diacore and De Beers deal, in Botswana, mining agreements are confidential.

The agreement did not involve Diacore’s local partners, which include Diacore Botswana Limited, or Steinmetz Diamonds Botswana Limited.

A receptionist with Diacore’s South Africa branch telephonically acknowledged receipt of our email, but the company did not respond to queries. Neither De Beers nor Debswana responded to interview questions with Debswana deferring these via email to De Beers.

Underrepresented Values

Before 2014, Debswana’s financial dealings were confidential. But in that year, and in an attempt to validate the relocation of De Beers sorting center, De Beers published what they called the first study “to quantify the economic value generated by the partnership in Botswana in any one year”. They disclosed a figure of $6.9 billion in revenue. The largest proportion, about $2.3 billion, was invested in rough diamond imports from South Africa, Namibia and Canada. But this figure is not an accurate reflection of “any one year” as it was affected by the relocation of De Beers’ sorting centre in 2014, and the resulting inflow and outflow of diamonds. Therefore, the full figure does not represent value that remains in Botswana but a large portion that flows in and out. The Bank of Botswana’s annual report disclosed that, from an income point of view, the revenue generated from the import and export of the diamond sorting center is not substantive and “largely offsetting”.

The remaining figures in De Beers’ study are vague: $0.6 billion in service fees internationally and locally; $0.7 billion in dividends for shareholders; and $0.3 billion in retained earnings. The most interesting figure is the $2.2 billion remitted to the government. Of this figure, $1 billion was generated through taxes and royalties and a further $1.2 billion through dividends. The value derived by De Beers is not known.

But a bigger question remains: just how much are diamonds from Botswana are actually producing in value? In 2013, for instance, De Beers tallied recovered diamonds from Namibia, South Africa, Botswana and Canada at 31.1 million carats. Botswana’s production was 22.7 million carats. In that same year, an estimated $18 billion in rough diamonds had been produced globally; De Beers produced $5.9 billion in value and Botswana, a whopping $4.2 billion. De Beers itself confirmed that from all mining operations, “Debswana … produces the majority of De Beers’ diamonds.” The company’s dependence on Botswana is clear.

World’s Longest PPP

De Beers is Botswana’s primary corporate partner and the two have been involved with what is considered as one of the world’s longest public-private partnerships. De Beers has gone so far as to give Botswana a 15% share in the corporation and Botswana has established a sovereign fund to ensure that the finite resource of diamonds can reap indefinite revenues.

In 2014, during the rare economic analysis of value generated for Botswana in its partnership with De Beers, De Beers claimed that Debswana’s total distribution to the government was around 39%. Sources confirmed that diamonds provided between 38% to 50% of Botswana’s national revenue. It also contributes more than 70% of foreign exchange earnings.

This situation should provide the government of Botswana a particularly strong bargaining position when it comes to assigning mining licences and obtaining fair share of diamond revenues.

Yet sources described this as a passive partnership on the part of the government, which allocates control over production volume, pace, diamond valuation and buyers to De Beers. As a result, diamond sales are often negotiated in tax havens through confidential agreements.

The Presidency, Secrecy and Wikileaks

Concern about the relationship between Botswana’s ruling BDP party and De Beers has prevoiusly been published in Wikileaks.

According to a confidential cable, Debswana financed a De Beers selected consultant to determine the internal structure of the party, including the presidency. “The BDP first contracted Schlemmer after the 1994 election… Although Schlemmer wrote that report for the BDP… then Chairman of Debswana Louis Nchindo paid for the study personally… The 2005 study was paid for by a mining firm with significant interests in Botswana ‒ i.e. De Beers. Schlemmer recommended that President Masire retire early and that the BDP bring Ian Khama into politics to unify the Party. The BDP scrupulously adhered to his recommendations.”

The failure of Botswana’s government to publish key documents and information such as mining agreements, disaggregated financial revenue generated within and outside of Botswana, the process of valuation and price of rough diamonds produced, and a registry of exceptional diamonds is worrisome. More importantly the internal funding structure of the BDP and its top officials also present in government and diamond structures.

It fuels fears that Botswana’s secretive diamond economy is potentially constructed around the coinciding and self-perpetuating interests of a ruling party and a private entity. Transparency of both De Beer’s corporate dealings and the BDP’s formal and informal funding sources would allay the concern that diamond deals are not necessarily always concluded in the interests of the broader Botswana society.