First Quantum: total Q2 2022 copper production was 192,668 tonnes

TORONTO – In Q2 2022, First Quantum Minerals reported gross profit of $629 million, EBITDA of $906 million, net earnings attributable to shareholders of $0.61 per share, and adjusted earnings of $0.49 per share. Relative to the first quarter of this year (“Q1 2022”), second quarter financial results were impacted by a declining copper price, inflationary pressures on costs and lower sales volumes of copper, gold and nickel.

Total copper production for the second quarter was 192,668 tonnes, a 6% increase from Q1 2022. The quarter-over-quarter increase in production was entirely attributable to Cobre Panama, which achieved quarterly records in mining volumes, throughput, and production.

At both Kansanshi and Sentinel, lower grades continued into Q2 2022, which contributed to lower copper production relative to the preceding quarter for both operations. Total copper production guidance for 2022 remains unchanged at 790,000 to 855,000 tonnes with full year production at Sentinel and Kansanshi expected to be towards the lower end of the guidance range.

Copper C1 cash cost of $1.74 per lb for Q2 2022 was $0.13 per lb higher than Q1 2022. While global inflationary pressures were present in the first quarter of this year, second quarter costs were further impacted by higher energy and commodity prices resulting from the conflict in Ukraine. Costs for fuel, explosives, freight, mill balls, reagents and other consumables represent almost half of the Company’s operational production cost base and unit costs in these areas continued to increase throughout the second quarter and rose above levels assumed in current guidance. Copper C1 unit costs were also impacted by lower production in Zambia. Copper C1 cash cost2 guidance range remains unchanged at $1.45 to $1.60 per lb. Unit costs over the next six months will be dependent on market rates for fuel and other key supplies, the market price of gold and other by-products, as well as production levels.

Q2 2022 OPERATIONAL HIGHLIGHTS

Total copper production for Q2 2022 was 192,668 tonnes, up from the 182,210 tonnes reported in Q1 2022, as Cobre Panama achieved record quarterly production while Kansanshi experienced lower production. Global logistical challenges persisted into the second quarter as a result of the flooding in parts of South Africa that affected the Port of Durban, the challenges posed by COVID-19 lockdowns in China, and the continued disruptions in marine traffic flow related to the Ukraine conflict. As a consequence of these constraints, copper sales volumes in Q2 2022 totaled 187,642 tonnes, approximately 5,000 tonnes lower than production during the quarter.

Copper C1 cash cost averaged $1.74 per lb in Q2 2022, up from $1.61 per lb in Q1 2022. Various inputs and operational costs continued to increase further during the second quarter. These include costs for fuel, explosives, sulphur, freight, reagents, liners and steel. Global inflationary pressures have been impacted by the COVID-19 pandemic as well as supply chain disruptions. Second quarter costs were further impacted by the wide-reaching sanctions imposed upon Russia due to the conflict in Ukraine.

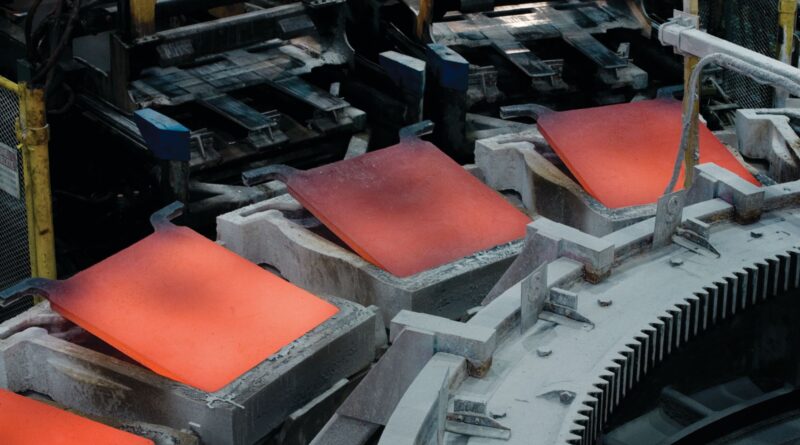

Cobre Panama delivered record copper production of 90,778 tonnes in Q2 2022, representing a 16% increase over production levels in the previous quarter. Cobre Panama saw an improvement in truck availability and increased grades in the second quarter. In addition, record mill throughput of 21.2 million tonnes was achieved in the second quarter, attributable to increased plant stability and continuous improvement projects. Copper C1 cash cost of $1.54 per lb was $0.11 per lb lower than the previous quarter as higher production volumes offset the impact of inflationary pressures for key consumables including explosives, fuel, steel for grinding media and liners, and higher freight charges. A collar structure for coal purchases continues to be in place with the ceiling price already exercised for July 2021 onwards, thereby limiting exposure to further increases in the thermal coal price until the end of 2023.

Kansanshi’s copper production of 39,719 tonnes in Q2 2022 was 2,180 tonnes lower than the previous quarter as a result of lower feed grades caused by current mining conditions. After an extended rainy season, higher than anticipated water levels in the M12 cutback restricted mining deployment, which led to supplementary plant feed from low grade stockpile. Water from this area is expected to be removed by the end of the third quarter of 2022, which will provide access to the scheduled oxide and mixed ore. In the quarter, a higher than normal proportion of sulphide feed came from narrow-veined regions as a result of the current mine layout and mining sequence. Recent detailed updates of the geological model confirm that a relatively small proportion, 20% of the sulphide ores, comprise vein-hosted areas and 80% from dominant stratiform mineralization. Ongoing reconciliation enhancements have elevated understanding of such areas, which will allow near-term mine plans and sequences to be improved and optimized. Copper C1 cash cost1 of $1.83 per lb was $0.37 higher than Q1 2022 due to price increases in key consumables and lower production.

Sentinel’s copper production of 52,447 tonnes in Q2 2022 was 28 tonnes lower than the previous quarter. Sentinel’s mine production of ore and waste remained behind the planned schedule in the second quarter of 2022, although progress has been made on preparing the pit for an improved second half of the year. As well, low truck availability and a backlog of truck maintenance continued from the first quarter. This was a direct impact of labour restrictions and resources during the COVID-19 pandemic, which is now subsiding. Copper C1 cash cost1 of $1.88 per lb was $0.27 per lb higher than the preceding quarter reflecting higher employee, freight, fuel, explosives, and consumable costs.

Ravensthorpe payable nickel production of 4,348 tonnes was 395 tonnes lower than the first quarter as production was impacted by wet weather, especially during April when heavy rainfall was experienced, which impacted materials handling and reduced beneficiation throughput in addition to low pre-leach extractions and limestone availability. Nickel C1 cash cost1 was $10.08 per lb, a $3.30 per lb increase as a result of higher processing costs due to increases in sulphur and fuel prices.