Glencore to co-acquire Cobar copper mine for US$1.1 billion

Glencore and Metals Acquisition Corp (MAC) have entered into a binding amendment agreement, amending terms announced on 17 March 2022, for the sale and purchase of Glencore’s Cobar copper mine in New South Wales, Australia.

Pursuant to the binding amendment agreement Glencore will receive consideration of US$1.1 billion as originally agreed with amended payment terms and a 1.5% net smelter return life of mine royalty upon completion of the transaction (see Appendix hereto).

MAC is a Special Purpose Acquisition Company (SPAC) listed on the New York Stock Exchange. The transaction is expected to be completed in the first quarter of 2023, subject to the approval of MAC’s shareholders and other customary closing conditions, including regulatory approvals.

Patrice Merrin is a director of Glencore plc and is also a director of MAC. Ms Merrin holds a <1% voting interest in MAC’s shares. MAC is not a related party of Glencore within the meaning of the UK Listing Rules.

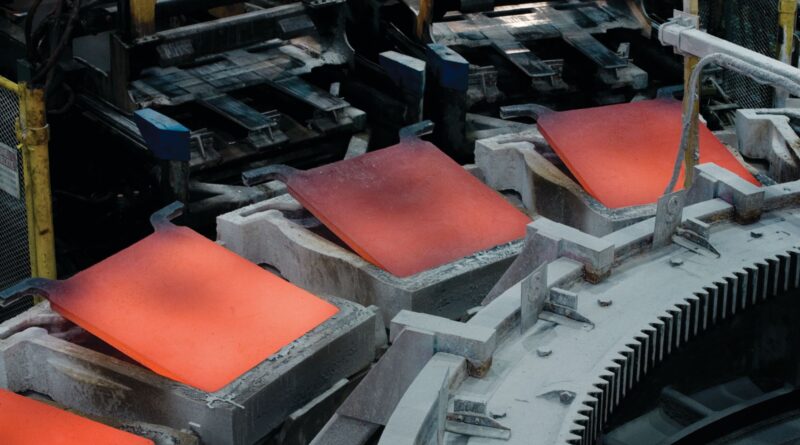

Glencore is one of the world’s largest global diversified natural resource companies and a major producer and marketer of more than 60 responsibly – sourced commodities that advance everyday life. Through a network of assets, customers and suppliers that spans the globe, we produce, process, recycle, source, market and distribute the commodities that enable decarbonisation while meeting the energy needs of today.

Glencore companies employ around 135,000 people, including contractors. With a strong footprint in over 35 countries in both established and emerging regions for natural resources, our marketing and industrial activities are supported by a global network of more than 40 offices.