Gold bullion sales rose 360% in may

During May 2021, the U.S. Mint sold 20,500 ounces of Gold American Eagles vs. only 11,500 ounces in May of 2020. American Buffalo gold coins were even more popular, with 44,000 one-ounce gold coins sold in May 2021 vs. just 2,500 ounces in May 2020. Despite the huge surge in gold sales during March 2020, due to the advent of COVID, gold bullion coin sales at the U.S. Mint through the first five months of 2021 was 40% larger.

Remember, the U.S. Mint also limited sales as they prepared for the July launch of the Type II gold and silver eagles.

There is great interest in this year’s American Eagle series as there will be a design change on the reverse coming this July, the first design change since the series debuted 35 years ago in 1986. There will also be a significant debut of a special series of Morgan and Peace Silver Dollars to honor the centennial of the year in which the two series made their transition in 1921 – the final Morgan Dollar mint year, and the first Peace Dollar mint year. These series will also debut this fall, making 2021 a “Year of Transition.”

We continue to see steep premiums on American Eagles due to delays in deliveries, limited U.S. Mint sales and high demand. In transition years like this, high premiums are to be expected as collectors and investors seek out key dates like transition years where mintages can be divided between two design types.

The tremendous expansion of the U.S. money supply over the past year has resulted in the devaluation of the dollar and a rise in commodities. Even though other currencies are also being devalued through monetary expansion, the U.S. dollar’s over-printing is expanding faster, so the dollar is falling to other currencies.

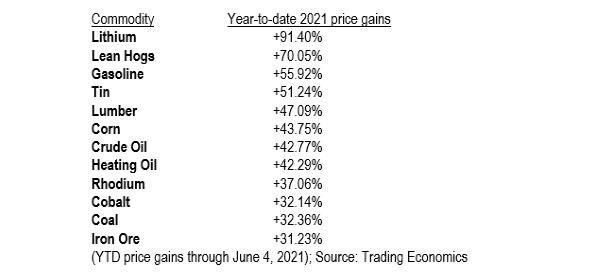

In the US, petrol prices are skyrocketing, and most energy prices are up 40% so far in 2021. Here are about a dozen commodities that are up over 30% year-to-date in 2021: