Gold Fields earnings up 300% on higher production and higher gold price

JOHANNESBURG – Gold Fields advises that headline earnings per share for the 12 months ended 31 December 2020 (FY 2020) are expected to range from US$0.81-0.85 per share, 305-325% (US$0.61-0.65 per share) higher than the headline earnings of US$0.20 per share reported for the 12 months ended 31 December 2019 (FY 2019).

Basic earnings per share for FY 2020 are expected to range from US$0.80-0.84 per share, 300-320% (US$0.60-0.64 per share) higher than the basic earnings of US$0.20 per share reported for FY 2019.

Normalised earnings per share for FY 2020 are expected to range from US$0.98-1.02 per share, 133-143% (US$0.56-0.60 per share) higher than the normalised earnings of US$0.42 per share reported for FY 2019.

The increase in basic and headline earnings is driven by slightly higher production and higher gold prices received, despite the hedges that were in place during 2020.

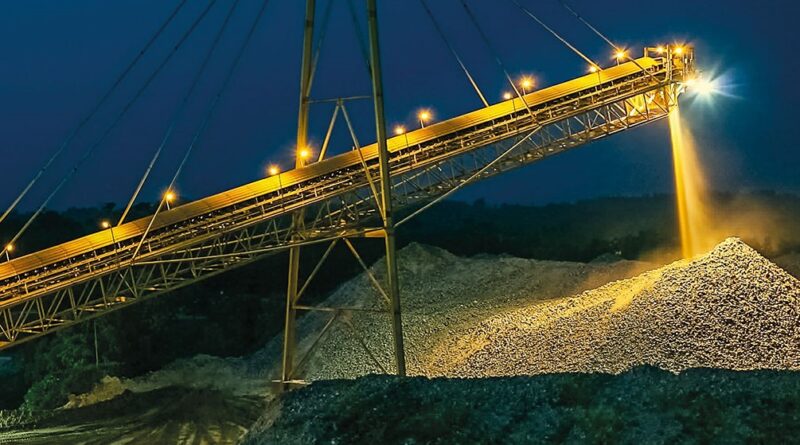

Gold Fields is a globally diversified gold producer with nine operating mines in Australia, Peru, South Africa and West Africa (including the Asanko JV), as well as one project in Chile.

The company has total attributable annual gold-equivalent production of 2.2Moz, attributable gold-equivalent Mineral Reserves of 51.3Moz and Mineral Resources of 115.7Moz.

STRONG END TO 2020

For Q4 2020, attributable gold equivalent production is expected to be 593koz (Q3 2020: 557koz), with All-in costs (AIC) for the quarter expected to be US$1,113/oz (Q3 2020: US$1,070/oz). All-in sustaining costs (AISC) are expected to be US$971/oz (Q3 2020: US$964/oz).

Attributable gold equivalent production for 2020 is expected to be 2,236koz, a 2% increase YoY (FY 2019: 2,195koz), within the revised guidance range of 2,200 – 2,250koz. Original guidance of 2.275Moz –2.315Moz was revised in May 2020 to account for the impact of Covid-19 on the operations, mainly at South Deep and Cerro Corona.

AIC for 2020 is expected to be US$1,079/oz, marginally higher than 2019 (FY 2019: US$1,064/oz) and within the revised guidance range of US$1,070/oz – US$1,090/oz. AISC for the year is expected to be US$977/oz (FY 2019: US$897/oz), again within the revised guidance range of between US$960/oz and US$980/oz.

The financial information on which this trading statement is based has not been reviewed, and reported on, by the Company’s external auditors.

Gold Fields expects to release FY 2020 financial results on Thursday, 18 February 2021.