Impala Refining Services is key competitive differentiator

Implats’ capacity to process and market Implats’ expanding production base remains a core competitive advantage, which will be leveraged for additional future benefit. 6E receipts in matte and concentrate from mine-to-market operations increased by 14% to 1.38 million ounces (FY2020: 1.21 million ounces) reflecting a recovery from a series of operational constraints in the previous comparable period, including processing challenges at Mimosa and Two Rivers, a temporary increase in smelter inventory at Zimplats, and reduced operating rates at South African operations due to the declaration of force majeure during the initial Covid-19 lockdown.

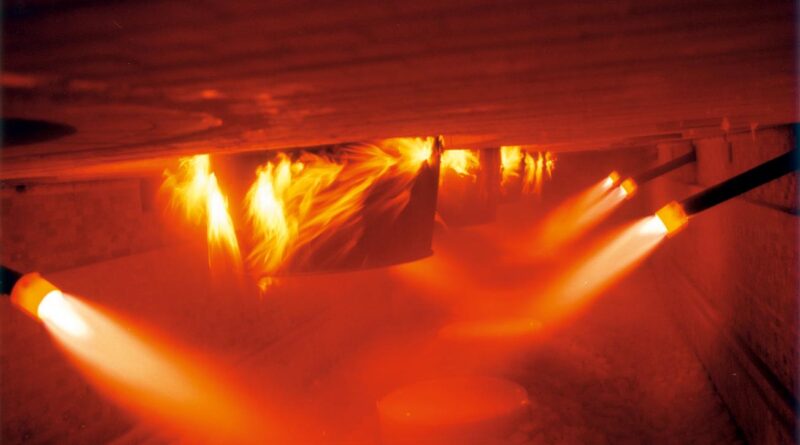

Impala Refining Services (IRS), a division of Impala, is a dedicated vehicle housing the toll-refining and metal concentrate purchases built up by Implats. IRS provides smelting and refining services through offtake agreements with Group companies (except Impala) and third parties.

6E receipts from third-party customers increased by 9% to 358 000 ounces (FY2020: 327 000 ounces), comprising 21% of gross receipts of 1.74 million ounces (FY2020: 1.54 million ounces). Reported operational and financial metrics for IRS in the prior year were impacted by the reallocation of stocks between IRS and Impala Rustenburg, which led to an increase in working capital. Consequently, despite being impacted by constrained Group processing capacity in H2 FY2021, refined 6E volumes increased by 17% to 1.69 million ounces (FY2020: 1.45 million ounces). Sales volumes increased by 25% to 1.81 million 6E ounces with a draw-down in rhodium, iridium and ruthenium inventory to take advantage of strong pricing for these metals. The cash operating costs associated with smelting, refining and marketing IRS production increased by 21% to R1.8 billion (FY2020: R1.5 billion).

Concentrate purchase agreements at IRS are dominated by ore feeds from Great Dyke and UG2 sources and rising minor PGM and base metal pricing, together with higher purchased volumes, resulted in the cost of metals purchased increasing by 66% to R63.3 billion (FY2020: R38.2 billion). IRS reported a gross profit of R9.5 billion (FY2020: R6.0 billion) and contributed R7.1 billion (FY2020: R4.3 billion) to Group headline earnings.

Free cash flow of R9.0 billion (FY2020: R116 million cash outflow) benefited from higher pricing and sales volumes and low contractual payments processed in Q1 which resulted in a positive working capital movement for FY2021.

OUTLOOK

Receipts at IRS in FY2022 will benefit from the delivery of Zimplats concentrates which were impacted by administrative delays in FY2021 and from growth in volumes expected at other mine-tomarket operations. Third party concentrate receipts are expected to be between 360 000 and 400 000 6E ounces.