Iron Ore & Coking Coal: Correction or collapse

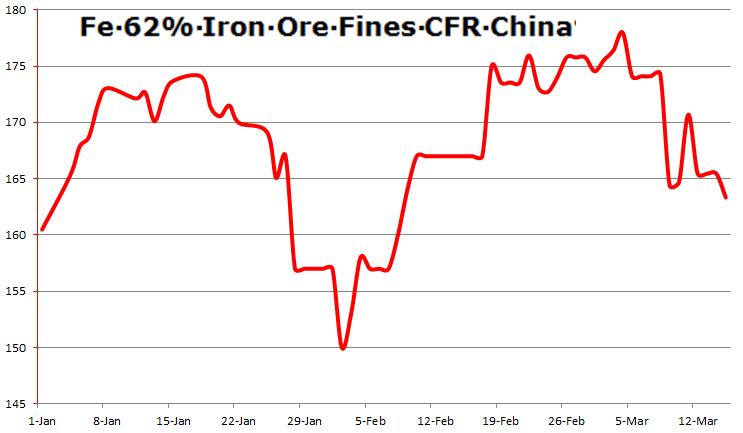

Pressured by the increased crackdown on polluting steel mills in Tangshan City in Hebei Province, benchmark physical 62% Australian iron ore fines corrected by USD 2.11 per tonne on 15 March to USD 163.33 per tonne CFR Qingdao, down by USD 15 or 8% from last high of USD 178 on 4 March, says Steel Guru Market Intelligence.

Tangshan authorities have vowed to crack down on illicit emissions after two weeks of heavy smog across northern China. Tangshan’s Deputy Mayor Mr Li Guifu ordered factories to limit or halt production on days when a heavy pollution alert was in place to reduce the overall emissions of air pollutants such as sulphuric dioxide or nitrogen oxide by 50%.

Mr Li told all factories to follow the city’s environmental protection plan, and warned that any steel and cement plants that fail to do so will have their pollutant discharge permits revoked and production suspended. He added that the consequences of failing to meet the requirements also include detention or criminal liability for the plant owner.

For companies that do not meet the environmental requirements, all their pollutant discharge permits will be revoked and their discharge performance rating will be cut to D, which would demand them to suspend production. Lower crude steel output could reduce iron ore usage.

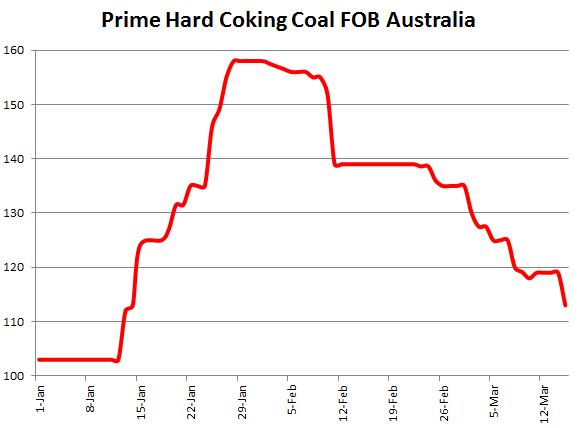

Similarly, coking coal prices crashed further on 15 March 2021 by USD 6 per tonne with IHS Markit reducing assessment of Prime Hard Australian Premium Coking Coal to USD 113 per tonne FOB, down by USD 5 per tonne or 28% as compared to last high of USD 158 in early February.

IHS Markit said “FOB basis Asian metallurgical coal prices decreased on Monday amid lower offers and trading levels. In the FOB market, a 16,200 tonne cargo of premium low-vol Peak Downs was concluded late Friday at USD 115.0 per tonne FOB Australia for April laycan, booked from BHP to a European steel mill.

Another 40,000 tonne of premium low-vol Peak Downs was also concluded at USD 115.0 per tonne FOB Australia for April laycan. A 75,000 tonne cargo of premium low-vol Peak Downs & Saraji loading in April was offered on-screen at USD 113.0 per tonne FOB Australia. In the paper market, the April contract traded at USD 110.0 per tonne FOB Australia, down sharply from Friday’s trade at USD 120.00 per tonne FOB Australia.