Ivanhoe Mines issues review of mine construction progress

TORONTO, Canada ‒ Ivanhoe Mines has announced its financial results for the year ended December 31, 2020. The highlights include:

- Development of the Kakula Mine, the first of multiple, planned mining areas at Ivanhoe Mines’ Kamoa-Kakula joint-venture copper project, is making excellent progress. Overall development of Kamoa-Kakula’s first phase, 3.8-million-tonne-per-annum (Mtpa) mining and milling operation is approximately 80% complete; first copper concentrate production remains on track for July 2021.

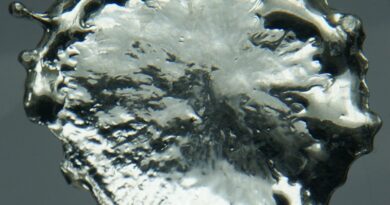

- At the end of December 2020, Kamoa-Kakula’s pre-production surface stockpiles contained approximately 1.52 million tonnes of high-grade and medium-grade ore at an estimated blended grade of 4.03% copper, containing more than 61,000 tonnes of copper, with a cost of only $110 million allocated to the stockpile. The combined pre-production high- and medium-grade ore surface stockpiles increased to approximately 2.16 million tonnes at an estimated grade of 4.44% copper at the end of February 2021.

- Kamoa-Kakula’s Phase 2 expansion is progressing to plan and is scheduled for Q3 2022 start-up, which will see a doubling of mill throughput to 7.6 Mtpa. Phases 1 and 2 combined are forecast to produce up to approximately 400,000 tonnes of copper per year. Based on independent benchmarking, the project’s phased expansion scenario to 19 Mtpa would position Kamoa-Kakula as the world’s second-largest copper mining complex, with peak annual copper production of more than 800,000 tonnes.

- Given the current copper price environment, Ivanhoe, together with its partner Zijin, is exploring the acceleration of the Kamoa-Kakula Phase 3 concentrator expansion from 7.6 Mtpa to 11.4 Mtpa, which may be fed from expanded mining operations at Kansoko or a new mining area at Kamoa North (including the Bonanza Zone). Kamoa Copper also is refining its longer-term downstream processing strategy, including the potential construction of a smelter or hydrometallurgical processing facility.

- In December 2020, the Kamoa-Kakula Copper Project secured $420 million in project-level credit facilities, including a EUR176 million ($211 million) covered equipment financing facility with a $9 million down-payment facility, and a $200-million line of credit from Zijin Mining. The credit facilities will be used, in part, to construct Kamoa-Kakula’s Phase 2 expansion to 7.6 Mtpa.

- In late December 2020, Kamoa-Kakula successfully completed conditions precedent of the equipment financing facility and drew down an initial tranche of $56 million from the facility, and $9 million from the down-payment facility.

- In order to support its growth plans, future capital needs and widen shareholder appeal, Ivanhoe Mines is considering the viability of seeking a secondary stock exchange listing on one or more international stock exchanges. Any such listing would be subject to market conditions and meeting listing requirements.

- Other engineering and construction activities underway at Kamoa-Kakula include the completion of upgrades at the Mwadingusha hydro-electric power plant and associated 220-kilovolt infrastructure to supply the mine with clean, renewable hydropower. The Mwadingusha hydropower plant is expected to deliver approximately 78 megawatts of power to the national electrical grid ahead of the start-up of the Kakula concentrator.

- A 2020 independent audit of Kamoa-Kakula’s greenhouse gas intensity metrics performed by Hatch Ltd. of Mississauga, Canada, confirmed that the project will be among the world’s lowest greenhouse gas emitters per unit of copper produced. Kamoa-Kakula’s outstanding economics are combined with first-class sustainability and social initiatives in keeping with the project’s goal of producing the world’s “greenest copper”.

- In 2020, Ivanhoe received environmental certificates on a large package of 100%-owned Western Foreland exploration licences that were acquired in 2019. Ivanhoe plans to soon commence an expansive exploration program on its Western Foreland licences that now total approximately 2,550 square kilometres of highly prospective land holdings in the vicinity of the Kamoa-Kakula mining licence. Ivanhoe’s DRC exploration group is targeting high-grade Kamoa-Kakula-style copper mineralization through a regional exploration and drilling program on the Western Foreland ground, which shares the same geological setting as Kamoa-Kakula.

- In February 2021, Ivanhoe announced that the company’s South African subsidiary, Ivanplats, is arranging project-level financing of up to $420 million to advance development of the world-scale Platreef palladium, platinum, rhodium, nickel, copper and gold project in South Africa.

- Ivanplats has signed a non-binding term sheet with Orion Mine Finance, a leading international provider of production-linked stream financing to base and precious metals mining companies, for a $300 million gold, palladium and platinum streaming facility. Ivanplats also has appointed two prominent, international commercial banks – Societe Generale and Nedbank – as mandated lead arrangers for a senior project debt facility of up to $120 million.

- Ivanplats’ proposed financings follow the November 30, 2020 issuance of the outstanding findings of an independent Platreef Integrated Development Plan 2020 (Platreef IDP20), which consists of an updated feasibility study (Platreef 2020 FS) and a preliminary economic assessment (Platreef 2020 PEA). The initial capital cost for the phased development plan under the Platreef 2020 PEA, starting at a mining rate of 700,000 tonnes per annum (700 ktpa), is estimated at $390 million.

- The Platreef IDP20 reflects the first phase of development for the Platreef Mine. It is designed to establish an operating platform to support potential future expansions up to 12 Mtpa, per previous studies. This would position Platreef among the largest platinum-group-metals mines in the world, producing in excess of 1.1 million ounces of palladium, platinum, rhodium and gold per year.

- Detailed engineering is underway on Platreef’s 700-ktpa initial mine design, 770-ktpa concentrator and associated infrastructure for the phased development plan, which is scheduled to be incorporated into an updated feasibility study before the end of 2021. The Shaft 1 changeover is progressing well in preparation for permanent hoisting by early 2022.

- At the Kipushi Mine redevelopment project in the DRC, the Kipushi Project’s draft feasibility study, and development and financing plan are being reviewed by Ivanhoe Mines together with its joint-venture partner and state-owned mining company, Gécamines. The project is maintaining a reduced workforce to conduct maintenance activities and pumping operations.

- Ivanhoe has made excellent progress in upgrading Kipushi’s underground infrastructure to allow for mining to quickly begin at the ultra-high-grade Big Zinc orebody. Resumption of production at the mine now requires the construction of a surface processing plant and other related surface production facilities. Discussions are continuing with Gécamines to advance a new era of production at Kipushi and it is anticipated that these discussions will be concluded with the finalization of the feasibility study and the agreement on the development and financing plan by mid-2021.

- At the end of 2020, Kamoa-Kakula had reached 2.6 million work hours free of a lost-time injury, Kipushi had reached 2.9 million work hours free of a lost-time injury, and Platreef had reached 59,000 work hours free of a lost-time injury.

Ivanhoe Mines is a Canadian mining company advancing its three mining projects in Southern Africa: the Kamoa-Kakula copper discovery in the Democratic Republic of Congo (DRC); the Platreef palladium-platinum-rhodium-nickel-copper-gold discovery in South Africa; and the extensive upgrading of the historic Kipushi zinc-copper-lead-germanium mine, also in the DRC.