MC Mining: As global economy improves so increases demand for coal

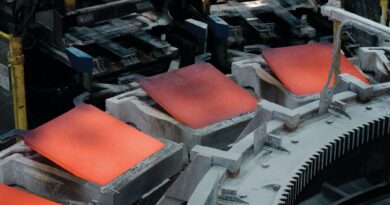

MC Mining, in its Activities report for the quarter ended 30 September 2021 says, the Uitkomst Colliery generated 120,260t of ROM coal during the quarter, 12% lower than the comparative Q1

FY2021. The decline is attributable to the four-day suspension of operating activities due to civil unrest and one of the underground mining sections encountering three dykes during the quarter.

Sales of high grade duff and peas were 18% higher than the FY2021 comparative period (64,673t vs. 54,877t) as prior year volumes were adversely affected by the delayed orders following the lifting of the COVID-19 lockdown.

Uitkomst also sold 5,872t of high ash middlings coal during the quarter (FY2021 Q1: 2,739t). Volumes were augmented by the disposal of coal stockpiles and Uitkomst had 3,164t of saleable coal on hand at the end of the quarter compared to 8,753t carried at the beginning of the quarter.

The global economic recovery from the pandemic resulted in higher demand for coal and this was accompanied by supply shortages and logistics constraints. As a result, the API4 export coal price continued to improve and average prices for the three months were 153% higher ($139/t vs $55/t) and, as a consequence, Uitkomst’s average revenue per tonne increased by 86% to $108/t (FY2021 Q1: $58/t). This price improvement was somewhat offset by the strengthening of the South African rand against the US dollar (FY2022 Q1: R14.62 vs. FY2021 Q1: R16.91 to US$1.00).

Production costs per saleable tonne increased 28% to $76/t (FY2020 Q4: $60/t) during the quarter due to the lower volumes mined and the strengthening of the South African rand against the US dollar.

To supplement working capital and to take advantage of higher prices, 16,500t of coal was presold realising R29.7 million ($2.1 million), which is to be delivered at the rate of 2,750t per month from September 2021 to February 2022.

MARKETS

The global economy continued to improve during the quarter, resulting in increased demand for coal. This led to a rise in the price of quality South African export thermal coal, with API4 prices improving to $139/t compared to $55/t recorded in Q1 FY2021 (FY2021 Q4: $105/t). Demand for hard coking coal also increased with average prices of $250/t compared to $112/t in Q1 FY2021.